A huge gap-down opening last week keeps the bearish outlook intact for the MCX gold futures contract. There is a strong resistance in Rs 29,880-30,500 zone. Rally to this will be a good opportunity for entering short-positions with a stop-loss at Rs 30,650. However, traders have to be cautious as the market could turn volatile after the US Federal Reserve meeting on Wednesday.

The 200-day moving average at Rs 28,583 will be a crucial support level. Declines below this support can take the price lower to Rs 25,500 over the medium-term. If the contract manages to sustain above the 200-day moving average support, then sideways movement between Rs 28,500 and Rs 30,500 is possible for the next few weeks.

Silver (Rs 44,776)

The corrective rally in the MCX silver contract from the low of Rs 42,418 found resistance at the 200-day moving average (currently at Rs 45,821) last week. The outlook remains bearish.

Traders can continue to hold on to their short positions with a revised stop-loss at Rs 46,300. The contract can fall to Rs 42,400 immediately and then to Rs 41,400. For the medium-term, Rs 41,400 and Rs 40,000 are the crucial support levels which might not be broken in a hurry.

Copper (Rs 461.7)

The MCX copper contract surged 3.5 per cent last week and the outlook has turned bullish. Significant supports are at Rs 456.5 and Rs 451.

Traders can go long now and accumulate on dips to Rs 455 with a stop-loss at Rs 448.

The contract can target Rs 470 immediately and then Rs 510.

The contract’s strong rise from the November low of Rs 428.85 is signalling a reversal of the downtrend that started in September. For the medium-term, Rs 510 will be a critical resistance level for the contract.

Crude oil (Rs 6,034)

The MCX crude oil contract has been continuing its consolidation in Rs 5,750-6,100 range for the seventh consecutive week within its overall downtrend. Traders have to wait for a breakout of this range to enter a trade.

A break above Rs 6,100 can take the contract higher to Rs 6,380. On the other hand, decline below Rs 5,750 can drag the price lower to Rs 5,680 immediately and to Rs 5,500 thereafter.

In the short-term, the probability of the contract breaching Rs 6,100 and moving to Rs 6,380 is higher. However, the medium-term trend is down and a fall to Rs 5,500 looks more likely.

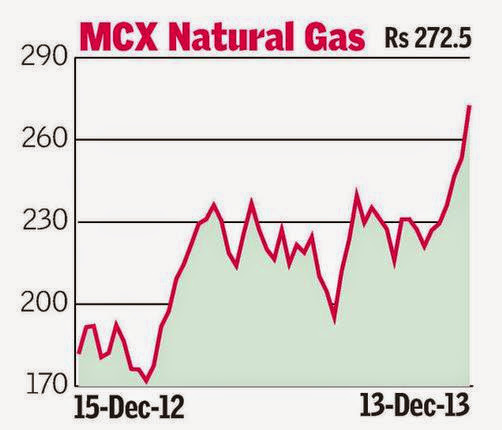

Natural gas (Rs 272.5)

The MCX natural gas contract closed at its medium-term bull channel resistance last week. The price action in the coming week will be crucial to know the direction in the coming weeks. Key resistances are at Rs 276 and at Rs 282.

However, since the contract has risen consistently in the last six weeks, the probability is high for a corrective pull back. Immediate support is at Rs 270. Decline below this support can take the contract lower to Rs 262 and Rs 252. Short-term traders with high risk appetite can go short if the contract declines below Rs 270 with a stop-loss at Rs 277.