Here are the best and worst performing assets broken down by the three key time periods as we leave the first half of 2014 (it's not been a good year for wheat).

June

- Best: Silver

- Worst: Wheat

Q2

- Best: Russia's MICEX stock market

- Worst: Wheat

First Half

- Best: Italy's FTSE-MIB stock market and Spain's IBEX - thanks Draghi TLTRO

- Worst: Wheat

Some additional commentary from Deutsche Bank:

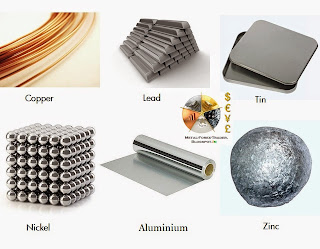

In YTD terms, of the main indices we track the FTSE-MIB (+14.5%) and the IBEX (+12.8%) have been the star performers. Spanish, Portuguese and Italian bonds have not been far behind. Interestingly commodities make up quite a few of the other top ten places (with the CRB index, Gold, Silver and Oil returning between 7-11%), but also 2 of the worst 3 with Wheat and Copper both down more than 6%. Also negative was Chinese equities (-1.5%) after disappointing growth in H1 which may explain some part of the weakness for certain commodities. The Nikkei (-6.1%) was the only other asset lower YTD in our sample. Apart from these four all the other assets saw a positive 2014 total return. Credit has put in a good performance in 2014 so far with most major indices returning between 4-7% which is impressive in the low yield, low spread environment.

Source: Deutsche Bank