Earlier today, Macquarie released a must-read report titled "Further deterioration in China’s corporate debt coverage", in which the Australian bank looks at the Chinese corporate debt bubble (a topic familiar to our readers since 2012) however not in terms of net leverage, or debt/free cash flow, but bottom-up, in terms of corporate interest coverage, or rather the inverse: the ratio of interest expense to operating profit. With good reason, Macquarie focuses on the number of companies with "uncovered debt", or those which can't even cover a full year of interest expense with profit.

The report's centerprice chart is impressive. It looks at the bond prospectuses of 780 companies and finds that there is about CNY5 trillion in total debt, mostly spread among Mining, Smelting & Material and Infrastructure companies, which belongs to companies that have a Interest/EBIT ratio > 100%, or as western credit analysts would write it, have an EBIT/Interest < 1.0x.

As Macquarie notes, looking at the entire universe of CNY22 trillion in corporate debt, the "percentage of EBIT-uncovered debt went up from 19.9% in 2013 to 23.6% last year, and the percentage of EBITDA-uncovered debt up from 5.3% to 7%. Therefore, there has been a further deterioration in financial soundness among our sample."

To be sure, both the size (the gargantuan CNY22 trillion) and the deteriorating quality (the surge in "uncovered debt" companies) of cash flows, was generally known.

What wasn't known were the specifics of just how severe this bubble deterioration was for the most critical for China, in the current deflationary bust, commodity sector.

We now know, and the answer is truly terrifying.

Macquarie lays it out in just three charts.

First, it shows the "debt-coverage" curve for commodity companies as of 2007. One will note that not only is there virtually no commodity sector debt to discuss, at not even CNY1 trillion in debt, but virtually every company could comfortably cover their interest expense with existing cash flow: only 4 companies - all in the cement sector - had "uncovered debt" 8 years ago.

Fast forward to 2013 when things get bad, as about a third of all corporations are now unable to cover their annual interest expense, even as the total addressable corporate debt has soared to CNY4 trillion for just the commodity sector.

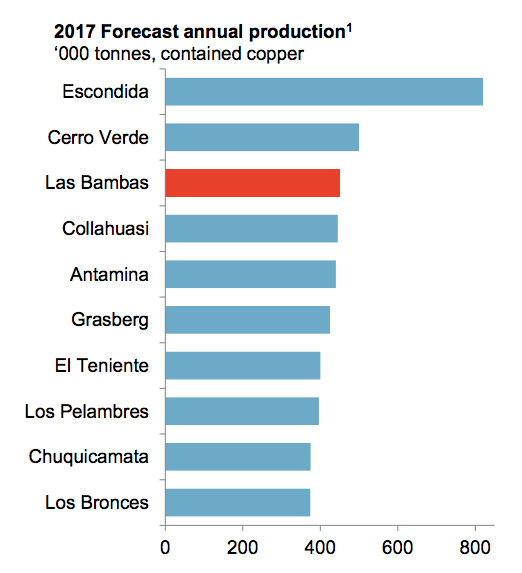

And then in 2014, everything just falls apart. Quote Macquarie, "more than half of the cumulative debt in this sector was EBIT-uncovered in 2014, and all sub-sectors have their share in the uncovered part, particularly for base metals (the big gray bar on the right stands for Chalco), coal, and steel."

Compared with the situation in 2013, while almost all sub-sectors did worse in 2014, but things appear to have worsened faster for coal companies as more red bars have moved beyond the 100% critical level for EBIT-coverage.

It means that last year about CNY2 trillion in debt was in danger of imminent default.

The situation since than has dramatically deteriorated.

So are we now? Macquarie again: "Given the slumps in metal and coal prices so far this year, it’s quite likely the curve will have deteriorated further for commodity firms this year, with total debt getting better in the meantime."

In other words, it is safe to assume that up to two-third of Chinese commodity companies are now at imminent danger of default, as they can't even generate the cash to pay down the interest on their debt, let alone fund repayments.

We fully expect this to be the source of the next market freakout: when the punditry turns its attention away from macro China, which has more than enough problems to begin with, and starts to focus on the cash flow devastation in China at the micro, or corporate, level.