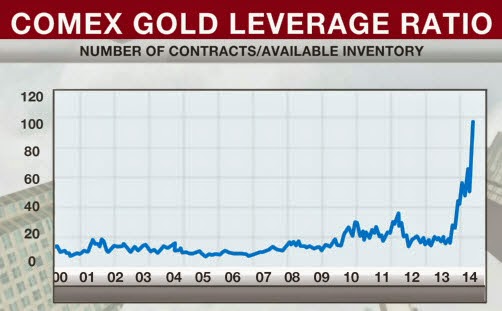

As BNN reports, veteran trader Tres Knippa, pointing to recent futures data, says "there may not be enough gold to go around if everyone with a futures contract insists on taking delivery of physical bullion." As he goes on to explain to a disquieted anchor, "the underlying story here is that the people acquiring physical gold continue to do that. And that’s what is important," noting large investors like hedge fund manager Kyle Bass are taking delivery of the gold they're buying. Knippa's parting advice, buy physical gold; avoid paper.

Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Sunday, January 19, 2014

Wednesday, January 15, 2014

Commodities trade dips over 36% in Apr-Dec

Commodities exchanges saw a heavy decline in trading during the first nine months (April-December) of the current fiscal. This comes in the backdrop of all-round deceleration in agri and non-agri commodities trade.

According to the latest data from commodities market regulator Forward Markets Commission (FMC), trade was down both in value and volume terms.

In terms of volume, the total trade declined to 71.22 crore tonnes in April-November 2013-14, from 112.38 crore tonnes in the corresponding period last year. At the same time, the trade value shrunk to Rs 82.46 lakh crore (Rs 129.62 lakh crore).

Market analysts said though commodities transaction tax (CTT) had been imposed only on non-agri commodities, it had impacted the overall mood in the market. As a result, trade value for agri commodities and bullion (gold and silver) saw a significant decline.

Lower volatility and higher bid-offer spread (impact cost) also hit intra-day traders, as transaction costs increased drastically, the analysts said.

This drove away genuine hedgers who felt the pinch of the rise in hedging costs. At the same time, trade volume was impacted by fund diversion from commodities to equities, as riskier asset classes gave better returns in 2013.

The other reason for the decline in trade, the analysts said, was negative sentiments due to the NSEL payment crisis.

Rupee depreciation, too, increased volatility in commodity prices, as did the levy of higher margins and the abnormal spread in future contracts.

On the global front, quantitative easing or tapering by the US by reducing its monthly bond buying programme to $75 billion from $85 billion forced hedge funds and portfolio managers to readjust their portfolios. Since only newer financial companies are getting involved as active counter-parties on commodity exchanges.

Vandana Bharti, Assistant Vice-President (Commodity Fundamental and Research) with SMC, has outlined a strategy to grease the wheels of the market.

More platforms

This includes giving more platforms to corporate hedgers for physical exposure, proactive policies to help the exchanges grow by introducing options, integration with banks and allowing them to participate in the commodity markets and introduction of an e-trading platform as in CME Globex, among others.

This includes giving more platforms to corporate hedgers for physical exposure, proactive policies to help the exchanges grow by introducing options, integration with banks and allowing them to participate in the commodity markets and introduction of an e-trading platform as in CME Globex, among others.

“Farmers must want to take advantage of commodity exchanges, banks must trust them, the government must support them and everyone must recognise the value they add,” she said.

MCX-SX first to offer interest rate futures, starting Jan 20

The MCX Stock Exchange will be the first to offer live trading in new interest rate futures (IRF) in 10-year government bonds, starting on January 20.

The exchange has received approval of the Securities and Exchange Board of India (SEBI) to introduce IRFs.

“The exchange shall launch cash-settled Interest Rate Futures (IRF) on 10-year government security in the currency derivatives segment with effect from January 20,” MCX-SX said in a circular today.

The National Stock Exchange (NSE) and the BSE will also start live trading in IRFs this month. While the NSE will launch IRFs on January 21, the BSE will commence trading for the product on January 28.

According to MCX-SX, members of the currency derivatives segment and their users can participate in IRF trading.

“Members of equity derivatives segment will also be eligible to participate after compliance of relevant membership norms being issued separately,” it added.

In December 2013, the SEBI allowed the stock exchanges to introduce cash-settled IRFs on 10-year government bonds, a long-pending demand of market participants.

An IRF is a contract between a buyer and a seller for future delivery of an interest-bearing security such as government bonds.

The cash-settled IRFs will provide market participants with a better option to hedge against risks arising from fluctuations in interest rates.

The product will benefit banks, brokerage houses, insurance companies and primary dealers, among others.

The SEBI had said IRF will be introduced on a pilot basis and the product’s features will be reviewed based on the experience gained. To begin with, the regulator had said that serial monthly contracts with a maximum maturity of three months would be available.

Shanghai Metals Exchange TRADING HOLIDAYS 2014

| Holiday | Markets Closed | ||

|---|---|---|---|

| 01/01/2014 | Wednesday | New Year's Day | Shanghai Stock ExchangeCHINA |

| 01/02/2014 | Thursday | Additional New Year Holiday | Shanghai Stock ExchangeCHINA |

| 01/03/2014 | Friday | Additional New Year Holiday 2 | Shanghai Stock ExchangeCHINA |

| 01/30/2014 | Thursday | Lunar NY Eve 1 | Shanghai Stock ExchangeCHINA |

| 01/31/2014 | Friday | Lunar New Year 1 | Shanghai Stock ExchangeCHINA |

| 02/03/2014 | Monday | Lunar New Year 4 | Shanghai Stock ExchangeCHINA |

| 02/04/2014 | Tuesday | Lunar New Year 5 | Shanghai Stock ExchangeCHINA |

| 02/05/2014 | Wednesday | Lunar New Year 6 | Shanghai Stock ExchangeCHINA |

| 02/06/2014 | Thursday | Lunar New Year 7 | Shanghai Stock ExchangeCHINA |

| 02/07/2014 | Friday | Lunar New Year 8 | Shanghai Stock ExchangeCHINA |

| 04/04/2014 | Friday | Ching Ming Festival Eve | Shanghai Stock ExchangeCHINA |

| 04/07/2014 | Monday | Ching Ming Festival Holiday | Shanghai Stock ExchangeCHINA |

| 05/01/2014 | Thursday | Labour Day 1 | Shanghai Stock ExchangeCHINA |

| 05/02/2014 | Friday | Labour Day Holiday 2 | Shanghai Stock ExchangeCHINA |

| 06/02/2014 | Monday | Dragon Boat Festival (Tuen Ng Day)* | Shanghai Stock ExchangeCHINA |

| 09/08/2014 | Monday | Mid-autumn Festival* | Shanghai Stock ExchangeCHINA |

| 10/01/2014 | Wednesday | National Day 1 | Shanghai Stock ExchangeCHINA |

| 10/02/2014 | Thursday | National Day 2 | Shanghai Stock ExchangeCHINA |

| 10/03/2014 | Friday | National Day 3 | Shanghai Stock ExchangeCHINA |

| 10/06/2014 | Monday | National Day 6 | Shanghai Stock ExchangeCHINA |

| 10/07/2014 | Tuesday | National Day 7 | Shanghai Stock ExchangeCHINA |

Monday, January 13, 2014

Subscribe to:

Comments (Atom)