Chinese smelters increase production to take advantage of bull run

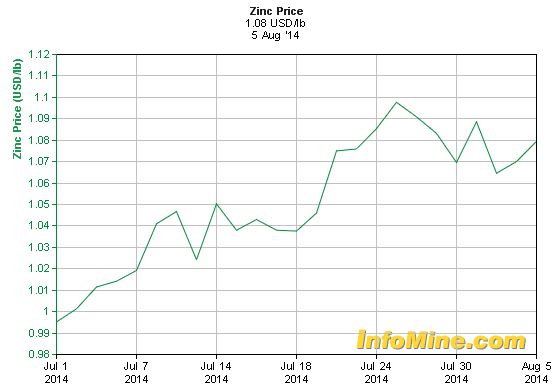

With a gain of over 20 per cent in the last 12 months, zinc is one of the top five gainers among ferrous and non-ferrous metals in the commodities market. But it is unlikely that zinc will make much headway over the next few months.

One of the reasons for the rally to stall will be rising supply especially with China increasing the output to benefit from the high prices that are prevailing now. A sign of things to come could possible be last week’s fall in zinc prices by four per cent.

Price forecast

On Monday, zinc fell below $2,300 a tonne to $2,295 for delivery in November. From the weekend closing, the drop was $34.

BNP Paribas sees zinc averaging $2,205 in the October quarter and $2,270 in the last quarter. Currently, cash zinc prices are ruling at $2,332 and they are expected to drop to levels of $2,090 this year, according to analysts. Next year, prices could rise to $2,244.

Last week, price fell mainly because London Metal Exchange inventories increased by over five per cent to 6.91 lakh tonnes. It was biggest rise in a week after April. Inventories have also increased in China.

Speculation

Ironically, zinc zoomed because stocks are down by 2.41 lakh tonnes a year. So, what has changed now that the zinc’s progress could be halted?

According to Hermes Fund Managers Ltd, stocks in Chinese warehouses are rising. Reuters quoted Joseph Murphy, analyst with Herms Fund, as saying that the metals market is seeing drawdown in LME stocks but at the same time warehouse stocks are on the rise.

Zinc smelters will get better returns for producing more, which could result in the metal prices being dented.

Hermes said refined zinc demand will exceed supply by 2.5 lakh tonnes this year and 2 lakh tonnes next year, according to BNP.

Traders on LME say that speculation in zinc is ending by shifting to other metals such as aluminium, nickel and lead.

Funds have cut their bearish bets to 39,368, according to LME commitment of traders data, down from over 40,000 in the last week on July.

Copper fallout

Murphy said that ample supplies of zinc concentrate and higher charges for treating apart from surging domestic prices should encourage smelters in China to boost zinc output.

Zinc is also gaining because a probe by Chinese officials revealed that copper is being used as a financial tool. This has moved speculators and hedge funds to zinc on the Shanghai Futures Exchange.

The increasing interest in zinc is supported by Chinese data showing rise in imports to 68,476 tonnes in June, a six-month high. In comparison, copper imports have been dropping since April.

The problem with copper and aluminium is that Chinese authorities suspect that stocks of these metals have been offered as collateral manifold by a multi-national firm owned by a Singaporean.

But now with stocks tending to rise, some traders have taken their foot off the accelerator, while others have begun to cash in their position.

Some commodity brokerages have told their clients to hold back investments of zinc since it had run up too fast.

A drop in prices of zinc, used mainly for steel galvanising, means India could tend to gain as domestic rates are based on 15-day LME average.

hindubusinessline