| Jan 01 2016 | New Year's Day (Observed) | LME / COMEX / NYMEX / SHFE |

| Jan 18 2016 | Dr. Martin Luther King, Jr. (Observed) | COMEX / NYMEX |

| Feb 08 2016 | Spring Festival | SHFE |

| Feb 09 2016 | Spring Festival | SHFE |

| Feb 10 2016 | Spring Festival | SHFE |

| Feb 11 2016 | Spring Festival | SHFE |

| Feb 12 2016 | Spring Festival | SHFE |

| Feb 15 2016 | Presidents Day | COMEX / NYMEX |

| Mar 25 2016 | Good Friday | LME / COMEX / NYMEX |

| Mar 28 2016 | Easter Monday | LME |

| Apr 04 2016 | Tomb-sweeping Day | SHFE |

| May 02 2016 | Labor Day | SHFE |

| May 02 2016 | Early May Bank Holiday | LME |

| May 25 2016 | Memorial Day | COMEX / NYMEX |

| May 30 2016 | Spring Bank Holiday | LME |

| Jun 09 2016 | Dragon Boat Festival | SHFE |

| Jun 10 2016 | Dragon Boat Festival | SHFE |

| Jul 04 2016 | Independence Day | COMEX / NYMEX |

| Aug 29 2016 | Summer Bank Holiday | LME |

| Sep 5 2016 | Labor Day | COMEX / NYMEX |

| Sep 15 2016 | Mid-autumn Festival | SHFE |

| Sep 16 2016 | Mid-autumn Festival | SHFE |

| Oct 03 2016 | National Day | SHFE |

| Oct 04 2016 | National Day | SHFE |

| Oct 05 2016 | National Day | SHFE |

| Oct 06 2016 | National Day | SHFE |

| Oct 07 2016 | National Day | SHFE |

| Nov 24 2016 | Thanksgiving | COMEX / NYMEX |

| Dec 26 2016 | Christmas Holiday (Observed) | LME/ COMEX / NYMEX |

| Dec 27 2016 | Boxing Day | LME |

| Jan 02 2017 | New Year's Day (Observed) | LME / COMEX / NYMEX / SHFE |

| * COMEX/NYMEX early closing on any business day preceding a holiday. | ||

Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Wednesday, January 27, 2016

Commodity Market Holiday Schedule 2016, LME COMEX NYMEX SHFE

MCX / NCDEX Holiday Schedule 2016

| Particulars | Date | Days | Morning Session (10:00 AM to 05:00 PM) | Evening Session (05:00 PM to 11:55 PM) |

| New Year´s Eve | 01-01-2016 | Friday | Open | Closed |

| Republic day | 26-01-2016 | Tuesday | Closed | Closed |

| Mahashivratri | 07-03-2016 | Monday | Closed | Open |

| Holi | 24-03-2016 | Thursday | Closed | Open |

| Good Friday | 25-03-2016 | Friday | Closed | Closed |

| Dr. Ambedkar Jayanti | 14-04-2016 | Thursday | Closed | Open |

| Ram Navami | 15-04-2016 | Friday | Closed | Open |

| Mahavir Jayanti | 19-04-2016 | Tuesday | Closed | Open |

| Maharashtra Day/ May Day (Labour Day) | 01-05-2016 | Sunday | Closed | Closed |

| Buddha Pornima | 21-05-2016 | Saturday | Closed | Closed |

| Ramzan ID (Id-Ul-Fitar) | 06-07-2016 | Wednesday | Closed | Open |

| Independence Day | 15-08-2016 | Monday | Closed | Closed |

| Ganesh Chaturthi | 05-09-2016 | Monday | Closed | Open |

| Bakri ID (Idu’L Zuha) | 13-09-2016 | Tuesday | Closed | Open |

| Gandhi Jayanti | 02-10-2016 | Sunday | Closed | Closed |

| Dussera | 11-10-2016 | Tuesday | Closed | Open |

| Moharum | 12-10-2016 | wednesday | Closed | Open |

| Diwali (Laxmi Puja) | 30-10-2016 | Sunday | Closed | Open from (5 pm to 9.00 - 9.30 pm) |

| Diwali - Balipratipada | 31-10-2016 | Monday | Closed | Open |

| Guru Nanak Jayanti | 14-11-2016 | Monday | Closed | Open |

| Id-E-Milad (Prophet Mohammad´s Birthday) | 12-12-2016 | Monday | Closed | Open |

| Christmas | 25-12-2016 | Sunday | Closed | Closed |

Friday, January 22, 2016

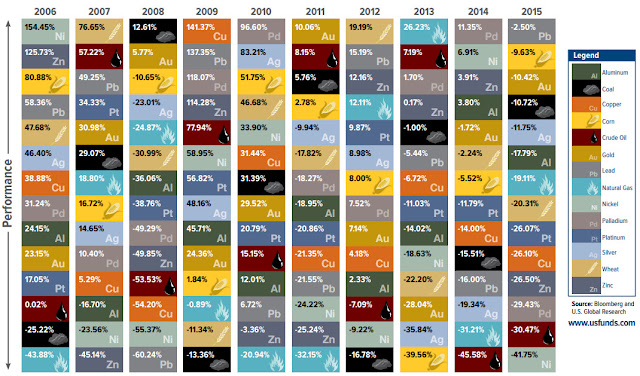

INFOGRAPHIC: The periodic table of commodity returns

Courtesy of: Visual Capitalist

At the beginning of each year, U.S. Global Investors puts out a fantastic visualization called the Periodic Table of Commodity Returns. This year’s version has an interactive design that allows users to sort returns by various categories including returns, volatility, and other groupings.

For those keeping score, 2015 was a historically bad year for commodities in almost every regard.

Base Metals: The fact that lead was the best performing commodity with -3.5% returns throughout 2015 is not a good sign. However, compared to its fellow base metals such as copper (-26.1%), zinc (-26.5%), aluminum (-17.8%), and nickel (-41.8%), lead did wonderfully in comparison.

Precious Metals: Gold held in there as a relative top-performer with only a -10.4% dip. That said, it’s started off 2016 with a nice rally so far. Silver, platinum, and palladium did worse in 2015, all returning -11.8%, -26.1%, and -29.4% respectively.

Energy: The worst performing commodity of 2014 was the second-worst performing commodity of 2015. Oil was been routed in the last two years, with -45.6% and -30.5% returns respectively. Other fossil fuels have followed, with natural gas (-19.1%) and coal (-10.8%) both losing ground in 2015 as well.

Food: Corn was among the “best” performers, returning -9.6%. Wheat struggled more throughout 2015, returning -20.3%.

Deflating commodity prices also compounded with a strengthening dollar to hit currency markets hard, allowing Bitcoin to become the best performing currency of 2015 by far. Countries heavily reliant on commodity exports such as Canada, Brazil, Russia, Mexico, Australia, Norway, and South Africa had their currencies hammered in relation to the U.S. dollar.

Tuesday, January 12, 2016

Crude oil prices fall as much as 20% since beginning of the year

Crude oil prices continued a relentless dive early on Tuesday, falling as much as 20 per cent since the beginning of the year as analysts scrambled to cut their 2016 oil price forecasts and traders bet on further price falls.

US crude West Texas Intermediate (WTI) was trading at $30.98 per barrel at 0311 GMT on Tuesday, down 43 cents from the last settlement and more than 19 per cent lower than at the beginning of the year. WTI has shed over 70 per cent in value since the downturn began in mid-2014.

Brent crude futures fell 43 cents to $31.12 a barrel. Earlier they declined to $31.08, their lowest since April 2004. Brent has fallen 20 per cent in January and, like WTI, has declined on every day of trading so far this year.

Traders take record short positions

Trading data showed that managed short positions in WTI crude contracts, which would profit from a further fall in prices, are at a record high, implying that many traders expect further falls (see chart).

Analysts also adjusted to the early price rout in the year, with Barclays, Macquarie, Bank of America Merrill Lynch, Standard Chartered and Societe Generale all cut their 2016 oil price forecasts on Monday.

"A marked deterioration in oil market fundamentals in early 2016 has persuaded us to make some large downward adjustments to our oil price forecasts for 2016," Barclays bank said.

"We now expect Brent and WTI to both average $37/barrel in 2016, down from our previous forecasts of $60 and $56, respectively," it added.

$10/barrel?

But it was Standard Chartered that took the most bearish view, stating that prices could drop as low as $10 a barrel.

"Given that no fundamental relationship is currently driving the oil market towards any equilibrium, prices are being moved almost entirely by financial flows caused by fluctuations in other asset prices, including the USD and equity markets," the bank said.

"We think prices could fall as low as $10/bbl before most of the money managers in the market conceded that matters had gone too far," it added.

Saturday, January 9, 2016

Market Massacre: Worst Ever First Week Of Trading

This was the worst first week of the year for US equities... ever!

Dow... (even worse than 2008)

S&P...

Europe was a disaster...

And epic for China...

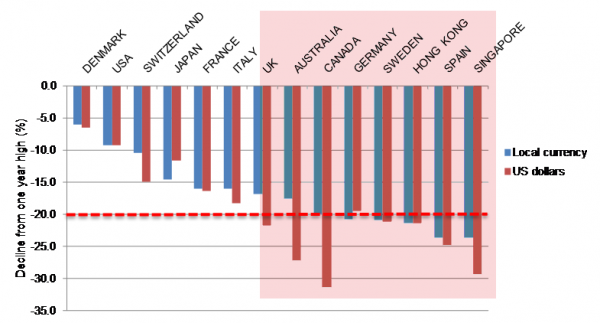

And while only Trannies are in a bear market (down 20%) in the US, these 7 developed world markets are already there...(h/t SocGen's Andrew Laphthorne)

Commodities were very mixed this week...

Gold rallied 4% this week - its best 'first week of the year' since 2008... (best week in 5 months) - breaking 2 key technical levels...

Crude down 5 days in a row touching a $32 handle at the lows... biggest weekly drop since Nov 2014

Wednesday, January 6, 2016

What Comes After The Commodities Bust?

The days of E&P companies using external debt financing to fuel growth have most likely come to a close.

The one thing executives should have learned in 2015 is that Wall Street can for long periods of time remain disconnected from fundamentals and can swing to extremes. Another lesson from 2015 is that OPEC can no longer be relied upon to set prices.

Thus, the debt fueled financing boom in the shale space will most likely never return.

As a result, the industry will likely move to self-funding capital expenditures through free cash flow generation in an attempt to significantly reduce its reliance on leverage. Debt levels will initially have to be reduced, significantly fueling a cycle of dramatically lower capital expenditures and consolidation. This process is already underway, but still has a long way to go.

When the internet bubble burst in 2001, only the business models that generated cash vs subscriber growth and cash burn survived and continued to get funded. Furthermore, larger companies survived and thrived as the smaller ones got starved for cash, died or dramatically scaled back subscriber acquisition to achieve a positive cash flow. We are about to experience the same consequences of misguided investments from a Federal Reserve-inspired bubble.

The toxic combination of lower capital expenditures and constrained output will result in another spike in prices, one that few will anticipate. The current Federal Reserve policy, which isn’t conducive to higher commodity prices, will also make the price spike more difficult to see ahead of time.However, in the interim, until policy changes at the Fed or OPEC are enacted, prices will remain below the marginal cost to maintain production.

This is especially true now that there are clear signs that the U.S. economy is weakening while the Fed chose to raise the federal interest rates in December. As we move through 2016, I expect a rash of bankruptcies tied to this transition to lower leverage, and towards the latter half of 2016 there will likely be a steep fall off of production.

Essentially most business models need to reset.

E&P companies that have a current leverage of over 4X Debt/EBITDAX and whose interest burden in some cases is over 30 percent of cash flow will eventually fail. I fully expect the new paradigm to be leverage ratios that are well under 4X Debt/EBITDAX.

Take a look at Pioneer Natural Resources (PXD) as a base case. Even with over 80 percent oil hedged through 2016, a leading cost structure and Debt/EBITDAX leverage of just over 1X, Pioneer will still not be FCF positive in 2016 and beyond according to most sell side models.

True the marginal call on cash is $500 million (25 percent of EBITDA) or more depending on the assumption of realized prices through asset sales. Furthermore it does assume double digit production growth, which will require more capital to achieve and higher cash burn but also comes with a hedge price of over $60 per barrel.

Looking at a smaller producer WPX Energy (WPX) on a flat production outlook and minimal hedges in 2016-17 with assumed WTI prices remaining under $50, they too will be free cash flow negative as leverage will remain over 3X Debt/EBITDAX approaching 4X by 2016 end. Their cash call will range from 15 percent of EBITDA to 35 percent in 2016 and 2017, according to JPM.

The point of this is that the current strip – even with hedges – doesn’t support free cash flow. That indicates that if the industry moves to free cash flow generation as a requirement and lower leverage, something has to give.

Business models are still adapting to the new paradigm. And many producers will go insolvent as debt markets close for them. Production will rationalize as depletion hits output and capital expenditures are cut further. Looking at PXD and WPX, it does not appear that this process of rationalization is over, which is especially true if prices remain under $50 per barrel. Nor has the negative feedback loop on lower capex, which spells trouble for new production to replace declining output later this year and next.

The de-leveraging that is occurring in E&P is a broader theme playing out in the global economy. Take China, for example, where growth was built on plentiful credit. But growth has slowed and credit is no longer as generous, both of which are leading to the need to correct debt levels – further fueling slower growth. I believe the Fed has realized that QE was increasingly having weaker positive outcomes. As a result it alternatively turned to a policy of a strong dollar knowing the impact on commodities. The EU QE only supports that dollar policy further in my view.

Eventually – maybe as soon as 2016 – the world will realize how wrong loose monetary policy has been and will turn back to more traditional means of growth through lower taxation and regulation. When that occurs it will come with altered Fed policy and corrections in equity and the dollar at a time when the commodity sector will not have the means to fuel supply growth.

Thus while the current downturn is not only unsustainable but is sowing the seeds for another commodity boom in prices, it will support supply growth through lower leverage and capital expenditures being primarily paid for by EBITDA or cash flow. This will require much higher commodity prices at some point.

Until then the unsustainable inverse relationship between NASDAQ and commodities will continue. The Fed’s policy has inflated assets while crushing commodities. That cannot continue indefinitely.

Tuesday, January 5, 2016

The Best And Worst Performing Assets Of 2015

Late in 2015, Germany's Handelsblatt reported, erroneously, that Venezuela was the best performing asset class of 2015.

It wasn't. The reason this was in error is because if one adjusts the returns into the real currency exchange rate, one which reflects the true implosion of the economy, instead of the government "mandated" one, the result is very different, one which shows that contrary to popular wisdom, during hyperinflation stocks are not a good store of value.

So what were the real best and worst performing assets of 2015? Here, with the full breakdown in both local currency and USD-redenominated terms, is DB's Jim Reid.

* * *

With markets wrapped up for 2015 now, reviewing the performance of asset classes last year shows that it was one where negative asset class returns were aplenty, while those finishing in positive territory were few and far between.

Indeed, of the 42 assets we monitor in Figure 5, just 9 finished with a positive return in Dollar-adjusted terms over the full year. Of these, the big winner was the Nikkei (+10.4%) - boosted by the accommodative BoJ and relatively stable Yen. In the periphery we saw both Portuguese (+6.5%) and Italian (+3.9%) equity markets also close higher, while in China the Shanghai Comp (+6.2%) finished up for the year but not without some huge volatility over the 12-months and of course ending well off the highs it posted back in June.

The S&P 500 (+1.4%) also closed just about in positive territory for the year on a total return basis although that performance was the worst for the index since 2008 as energy stocks clearly weighed for much of the year, while there was a similar return for US Treasuries (+0.8%).

At the other end of the scale there were some notable losers for us to pick out. In particular it was Oil which stole the limelight with huge falls for both Brent (-44.1%) and WTI (-30.5%) while Copper (-24.4%), Wheat (-20.3%), Silver (-11.7%) and Gold (-10.4%) were also hard hit. Both political and economic fragility saw Brazil (-42.0%) and Greece (-30.3%) fall the most in the equity space while EM equity markets finished with a broad -14.8% decline.

US Dollar strength was a big theme for 2015 as evidenced by the lack of winners above with the Dollar index returning a hefty +9.3% for the full year. This meant there were decent falls for the Euro (-10.3%), Aussie Dollar (-10.7%) and Canadian Dollar (-16.1%).

In local currency terms Russian equities (+32.3%) came out on top along with some of the peripheral markets. In the credit space it was the divergence between European and US credit which was most notable. Reflecting the higher exposure to energy credits, US HY closed with a -5.0% loss for the full year, while US IG was down a more modest -0.4%. In Europe we saw EUR HY finish +0.5% and EUR Sub Fins +1.4%, although EUR IG Corp was down -0.7%. Again converting this into US Dollar terms results in any gains for European credit being wiped out and in turn underperforming US credit for the full year.

Subscribe to:

Posts (Atom)