Commodity Trading News And Technical Analysis Reports.

Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Wednesday, October 26, 2016

Thursday, October 20, 2016

11 things every metal investor needs to know about Zinc

Here’s why the metal is back in fashion:

1. Zinc is a $34 billion per year market.

It’s bigger than the silver ($18 billion), platinum ($8 billion), and molybdenum ($5 billion) markets combined. In fact, it is the fourth-most used metal worldwide.

It’s bigger than the silver ($18 billion), platinum ($8 billion), and molybdenum ($5 billion) markets combined. In fact, it is the fourth-most used metal worldwide.

2. Zinc smelting and production technology came way later than it did for other metals.

The ancients were able to smelt copper, lead, and iron, but it wasn’t until much later that people were able to work with zinc in any isolated state.

The ancients were able to smelt copper, lead, and iron, but it wasn’t until much later that people were able to work with zinc in any isolated state.

3. Even despite this, it was a crucial metal for ancient peoples.

They would smelt zinc-rich copper ores to make brass, which was used for many different purposes including weaponry, ornaments, coins, and armor.

They would smelt zinc-rich copper ores to make brass, which was used for many different purposes including weaponry, ornaments, coins, and armor.

4. Zinc is also crucial to produce many alloys today.

For example, brass is used for musical instruments and hardware applications that must resist corrosion. Solder and nickel-silver are other important alloys.

For example, brass is used for musical instruments and hardware applications that must resist corrosion. Solder and nickel-silver are other important alloys.

5. The world’s first-ever battery used zinc as an anode.

The voltaic pile, made in 1799 by Alessandro Volta, used zinc and copper for electrodes with brine-soaked paper as an electrolyte.

The voltaic pile, made in 1799 by Alessandro Volta, used zinc and copper for electrodes with brine-soaked paper as an electrolyte.

6. The metal remains crucial for batteries today.

Zinc-air, silver-zinc, zinc-bromine, and alkaline batteries all use zinc, and they enable everything from hearing aids to military applications to be possible.

Zinc-air, silver-zinc, zinc-bromine, and alkaline batteries all use zinc, and they enable everything from hearing aids to military applications to be possible.

7. Galvanizing is still the most important use.

About 50% of the metal is used in galvanizing, which is essentially a way to coat steel or iron so that it doesn’t rust.

About 50% of the metal is used in galvanizing, which is essentially a way to coat steel or iron so that it doesn’t rust.

8. China is both a major producer and end-user.

China mined 37% of the world’s 13.4 million tonnes of zinc production in 2015. It consumed 47% of the world’s supply that same year.

China mined 37% of the world’s 13.4 million tonnes of zinc production in 2015. It consumed 47% of the world’s supply that same year.

9. Major mines have been shutting down.

In 2016, China ordered the shutdown of 26 lead and zinc mines in parts of the Hunan province for environmental reasons. Meanwhile, Ireland’s Lisheen Mine and Australia’s Century Mine both shut down last year after being depleted of resources. That takes 630,000 tonnes of annual production off the table.

In 2016, China ordered the shutdown of 26 lead and zinc mines in parts of the Hunan province for environmental reasons. Meanwhile, Ireland’s Lisheen Mine and Australia’s Century Mine both shut down last year after being depleted of resources. That takes 630,000 tonnes of annual production off the table.

10. Stockpiles are dwindling.

Warehouse levels are less than half of where they were in 2013.

Warehouse levels are less than half of where they were in 2013.

11. Zinc has been one of the best performing metals in 2016 in terms of price.

It started the year around $0.70/lb, but now it trades for $1.04/lb.Courtesy of: Visual Capitalist

Tuesday, August 2, 2016

This is what a broad-based metals and mining rally looks like

Gold may be grabbing the headlines with its best year-to-date performance in decades and silver's 48% surge in 2016 to above $20 an ounce is a big swing even for such a volatile metal, but this year's rally in commodities is broad-based and becoming more so.

After under performing gold in 2016, platinum has now overtaken the yellow metal with a year to date advance of a shade under 34%. A chunk of those gains came in July, the metal's best monthly performance since 2012. Sister metal palladium has also enjoyed its best month for nearly a decade, soaring 21.1% in July. With a 52% or $250 an ounce gain from trough to peak in 2016, palladium is now even besting silver.

Thermal coal is probably the biggest upset – seaborne prices are up 22% in 2016 to above $60 a tonne with most of those gains coming in recent weeks

Base metals have also enjoyed a breakout 2016 with across the board gains year-to-date. Measured from recent lows which mostly occurred at the end of 2015 and in January and February this year the recovery in prices this year is even more impressive.

One of the few decliners until recently, lead is still a laggard but now boasts a 2.7% rise in 2016 scaling $1,800 a tonne in July. Bellwether copper has also been lack luster adding only 3.3% in 2016 as it remains stuck below $5,000 a tonne, but elsewhere in the complex prices are in rapid advance.

Aluminum and cobalt, both up 9.4% so far this year haven't enjoyed the spectacular gains of the likes of likes of zinc (+40% to $2,275 a tonne) and tin (+24% just short of $18,000), but like nickel (+24%) which regained the $10,000 a tonne level in May, the metals could play catch up over the remainder of the year as Chinese demand picks up steam.

Steel making raw materials iron ore (+41% to top $60 a tonne on Monday) and coking coal (+29% and back in triple digits) have also come back strongly despite all predictions. Thermal coal is probably the biggest upset – seaborne prices are up 22% in 2016 to above $60 a tonne with most of those gains coming in recent weeks as a domestic clampdown by Beijing opens up opportunities for exporters.

Oil dipped below $40 a barrel today as the 2016 rally comes off the boil, but the commodity is still up more than 50% from its February low. Potash at levels not seen since 2007 and uranium languishing around $25 with few signs of improvement appear to be the exceptions that prove the rule for mined commodities this year.

Source: Steel Index, LME, Comex, Nymex, UX, Infomine. Prices at August 1, 2016

Wednesday, July 6, 2016

Friday, June 17, 2016

Sunday, April 24, 2016

Wednesday, April 6, 2016

Commodity prices set for significant rebound in 2016: Scotiabank

While commodity prices fell 0.3% in February and 25% year-over-year, the second half of the month saw the beginning of a price rally that is expected to continue throughout 2016, according to Scotiabank’s commodity price index released March 29.

As China’s economy has become less of a concern and the U.S. dollar has grown weaker, the outlook for commodity prices has improved. In March, prices are expected to see a “significant” rally, according to the index, from a decade low.

“Equally important, hedge and investment funds appear to be looking for reasons to bid commodity prices higher, after the rout of recent years,” said Scotiabank’s vice-president of economics and commodity market specialist Patricia Mohr.

“2016 should be a transition year for commodity prices, with the current slowdown in global capital spending in oil and gas and mining setting the stage for a strong rebound going into the next decade.”

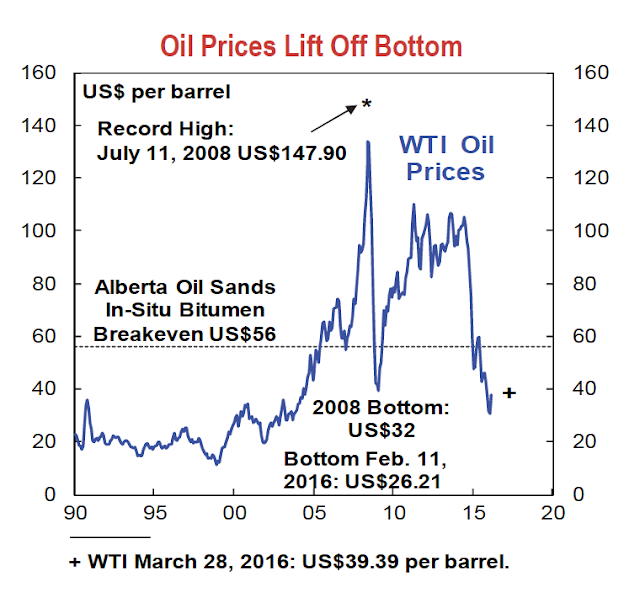

The 0.3% dip was driven by a 7.4% decrease in the oil and gas index, which has fallen almost 50% year-over-year. West Texas Intermediate (WTI) hit a low February 11, reaching US$26.21. This is down from a high of $147.90 in July 2008, which was right before the price plummeted and hit as low as $32 that same year.

As of March 28, WTI was priced at US$39.39 per barrel, an increase of 50% over the price recorded six weeks prior.

The recent rally relates to the increasing likelihood of a production freeze between OPEC and Russia, which will be the subject of an April 17 meeting in Doha.

“While cuts are not in the cards and Iran will not participate, a ‘freezing’ of production—particularly by Saudi Arabia and Iraq—will contribute to a gradual rebalancing of world supply with demand by late 2016 or early 2017,” Scotiabank said in its report.

“Pipeline sabotage and outages in northern Iraq and Nigeria contributed to firmer prices in February.”

The metal and mineral index grew 1.4% in February, and March is expected to see another increase. One reason for the rally is the rebound in prices for some metals, as demand is increasing above supply. Zinc prices are expected to strengthen as demand grows 3.6% this year due to increasing auto sales and production, construction in Europe and infrastructure spending in China and India. Iron prices have also jumped in advance of China’s peak construction period in April and May.

Subscribe to:

Posts (Atom)