Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Tuesday, August 25, 2015

Sunday, August 23, 2015

Carnage: Worst Week For Stocks In 4 Years, VIX Soars Most Ever

- China's worst week since July - closes at 5 month lows

- Global Stocks' worst week since May 2012

- US Stocks' worst week in 4 years

- VIX's biggest weekly rise ever

- Crude's longest losing streak in 29 years

- Gold's best week since January

- 5Y TSY Yield's biggest absolute drop in 2 years

* * *

Did you get message Fed?

THE CLEAR MESSAGE FROM THE MARKETS IS - HIKE RATES AND YOU'RE DONE, GIVE US QE4 OR IT'S ALL OVER!!!

So let's start with stocks...

Bloodbathery... This was the worst week for global stocks (MSCI World) since May 2012

And the worst week for US equities since Nov 2011...

Futures show the pain started with China PMI, then dumped as Europe collapsed, then there was no help from the machines as gamma was so imbalanced...

Of course we saw The BoJ in da house to help squeeze stocks with some USDJPY crushing...but that only worked for the small caps (easiest to squeeze)... and then it all collapsed...

Dow enters correction... this was the 9th largest point drop in the history of The Dow...

And The VIX ETF saw its biggest 2-day rise since 2011 (no wonder with 61.7mm shares short against just 60.6mm outstanding)

and before we leave stock-land, her is perhaps the 'spookiest' chart... a Fibonnaci 61.8% extension of the 2007 high to 2009 lows 'nails the top' for now... (h/t @allstarcharts )

FX was a disaster...

Tuesday, August 18, 2015

Chinese production restrictions may seriously impact Zinc consumption

The production restrictions for environmental protection inspections ahead of the 70th anniversary of the victory of the War against Japanese Aggression will significantly impact zinc consumption, SMM says.

Beijing, Tianjin, Hebei, Shandong, Shanxi, Henan and Inner Mongolia will execute restrictions on production to secure air quality for the big parade due to the 70th anniversary of the victory of the War against Japanese Aggression, SMM learned.

The production restrictions across the tire sector in Shandong will take a toll on zinc oxide demand. Most of tire producers in Shandong’s Dongying will be forced to cut output. Shandong has over 300 tire producers which produce 60% of the total tire output in China. Over 170 low-end tire producers are located in Dongying.

Most galvanized plate producers in Hebei’s Bazhou will also be forced to cut output, including large galvanized tube producer Hengshui Jinghua and Handan Youfa. Hebei and Tianjin have an agglomeration of galvanizers, which consume nearly 30% of China’s zinc output.

Operating rates at galvanizers and zinc oxide producers will thus slide further in August, SMM foresees, dampening zinc consumption.

Beijing, Tianjin, Hebei, Shandong, Shanxi, Henan and Inner Mongolia will execute restrictions on production to secure air quality for the big parade due to the 70th anniversary of the victory of the War against Japanese Aggression, SMM learned.

The production restrictions across the tire sector in Shandong will take a toll on zinc oxide demand. Most of tire producers in Shandong’s Dongying will be forced to cut output. Shandong has over 300 tire producers which produce 60% of the total tire output in China. Over 170 low-end tire producers are located in Dongying.

Most galvanized plate producers in Hebei’s Bazhou will also be forced to cut output, including large galvanized tube producer Hengshui Jinghua and Handan Youfa. Hebei and Tianjin have an agglomeration of galvanizers, which consume nearly 30% of China’s zinc output.

Operating rates at galvanizers and zinc oxide producers will thus slide further in August, SMM foresees, dampening zinc consumption.

Thursday, August 13, 2015

Emerging Market Currencies To Crash 30-50%, Jen Says

Less than 24 hours ago, we argued that although it might have seemed as though Brazil hit rock bottom in Q2 when it suffered through the worst inflation-growth mix in over a decade, things were likely to get worse still.

The country, which is also coping with twin deficits and a terribly fractious political environment, is at the center of what Morgan Stanley recently called “a triple unwind of EM credit, China’s leverage, and US monetary easing” and now that its most critical trading partner has officially entered the global currency war, all roads lead to further devaluation of the faltering BRL.

And it’s not just the BRL. As Bloomberg reports, former IMF economist Stephen Jen (who called the 1997 Asian crisis while at Morgan Stanley) thinks EM currencies could fall by an average of 30% going forward on the back of the PBoC’s move to devalue the yuan. Here’smore:

[The] devaluation of the yuan risks a new round of competitive easing that may send currencies from Brazil's real to Indonesia's rupiah tumbling by an average 30 percent to 50 percent in the next nine months, according to investor and former International Monetary Fund economist Stephen Jen.Volatility measures were already signaling rising distress in emerging markets even before China's shock move. An index of anticipated price swings climbed above a rich-world gauge at the end of July, reversing the trend seen for most of the past six months."If this is the beginning of a new phase in Beijing's currency policy, it would be the biggest development in the currency world this year,'' said Jen, founder of London-based hedge fund SLJ Macro Partners LLP. "The emerging-market currency weakening trend is now going global.''Latin America is a particular concern because of the region's high levels of corporate debt, said JenJen recommends selling the real, rupiah and South African rand -- all currencies of commodity exporters, which rely on China for a large chunk of their foreign earnings.As well as the drop in raw-materials prices, the prospect of higher interest rates in the U.S. has also drawn away investment, pushing a Bloomberg index of emerging-market exchange rates down 20 percent in the past year. A Latin American measure headed for its 13th monthly loss out of 14, while an Asian gauge plunged Tuesday to its lowest in six years.

And a bit more color from WSJ:

If China’s devaluation deepens, pressure to weaken currencies could become particularly intense in other Asian nations that export large amounts to China or compete with Beijing in other markets. Asian currencies tumbled on Tuesday, notably the South Korean won, Australian dollar and Thai baht, as investors bet China’s move could lead to further monetary easing in those nations. Many Asian nations have cut rates this year and could be forced to take further action in coming months.“A new theme has emerged—one of Asian currency weakness,” said Wai Ho Leong, an economist in Asia at Barclays.

To be sure, it's all down hill from here, and on that note, we'll reprise our conclusion from last week's "Emerging Market Mayhem" piece: Between an inevitable (if now delayed) Fed hike, stubbornly low commodities prices, the entry of the world's most important economy into the global currency wars, and, perhaps most importantly from a big picture, long-term perspective, a seismic shift in the pace of global demand and trade, we could begin to see a wholesale shift in which the markets formerly known as "emerging" quickly descend into "frontier" status and after that, well, cue the "humanitarian aid" packages.

* * *

Here's a look at the damage since Monday, right before the devaluation:

Monday, August 10, 2015

Is The "Smart Money" Ready To Bet On Gold?

For the last three weeks, gold has experienced something that has never happened before -hedge funds aggregate net position has been short for the first time in history.

However, as Dana Lyons notes, this week saw another 'historic' shift in gold positioning as commercial hedgers shifted to the least hedged since 2001... so the 'fast' money is chasing momentum and the 'smart' money is lifting hedges into them.

It’s no secret that commodities have taken a drubbing during the deflationary spiral over the past year. And precious metals have been right up front in this beating. This includes gold, which has lost over 40% of its value the past 4 years. So needless to say, there has not been much good news on that front. However, as we touched on in a piece two weeks ago, there are signs beginning to pop up that may provide a glimmer of hope for gold bugs. In dollar terms, the price of gold continues to leak, offering very little evidence of any impending stability or bounce. On the other hand, in Euro terms, gold prices reached a key juncturea few weeks ago, as outlined in that previous post. And while no bounce has materialized as of yet, gold has at least held at the level we noted.

Today’s Chart Of The Day offers another hopeful data point for gold bulls. The CFTC tracks the net positioning of various groups of traders in the futures market in a report called the Commitment Of Traders (COT). One such group is called Commercial Hedgers. As their name implies, their main function in the futures market is to hedge. And while the Non-Commercial Speculators tend to be trend-following funds, the Commercial Hedgers’ postions tend to move contrary to price trends. Thus, it is almost always the case that these Hedgers will be correctly positioned – and to an extreme – at major turning points in a market.

How is that relevant for gold? As of this week, Commercial Hedgers are holding the lowest net short position in gold futures since the launch of the gold bull market in 2001.

Does this mean that a reversal higher is imminent in gold? Not necessarily. The thing with COT analysis is that it is difficult to correctly determine when an “extreme” in Hedgers’ positioning will actually result in a price reversal. As is said regarding all sorts of market metrics, an extreme in COT positioning can always get more extreme. Plus, the COT positioning can peak well in advance of the turn. Consider the Hedgers’ maximum net short positioning in gold futures which occurred in December 2009, 21 months – and another 50% gold rally – before prices topped.

Thus, it is tough to time trades with accuracy based on the COT report. However, one thing we can say in the gold bugs’ favor: what had mostly been a headwind for gold for the past decade or so is no longer the case. While it may not make an immediate impact, the “smart money” Commercial Hedgers are now more aligned with them than at any point since the bull market began in 2001.

More from Dana Lyons, JLFMI and My401kPro.

How New Caledonia’s export ban hit Chinese Nickel ore market?

Indonesia introduced an export ban on nickel ore since early 2014, and now, New Caledonia decided to place a nickel ore export ban to China.

How the ban will affect China’s nickel ore market?

Last week, foreign media reported the heads of the national and local governments along with mining executives’ vetoed exports of nickel laterites to China because of New Caledonia's long-standing supply agreements with Australia.

“The New Caledonia nickel export to China will have a negligible effect as exports of nickel ore from the country are very small,” SMM’s nickel analyst says.

China imported 14.57 million ton of nickel ore during the first half of 2015, down 36.87% year-on-year, with 96.79% of imports from the Philippines, and 0.79% from Australia, the second-place supplier, according to China Customs.

So far, the country has placed no ban on ferronickel export to China. In June, China imported 62,500 ton of ferronickel, with 10,482 ton of imports from New Caledonia, up nearly 3-folds to rank second, according to China Customs.

How the ban will affect China’s nickel ore market?

Last week, foreign media reported the heads of the national and local governments along with mining executives’ vetoed exports of nickel laterites to China because of New Caledonia's long-standing supply agreements with Australia.

“The New Caledonia nickel export to China will have a negligible effect as exports of nickel ore from the country are very small,” SMM’s nickel analyst says.

China imported 14.57 million ton of nickel ore during the first half of 2015, down 36.87% year-on-year, with 96.79% of imports from the Philippines, and 0.79% from Australia, the second-place supplier, according to China Customs.

So far, the country has placed no ban on ferronickel export to China. In June, China imported 62,500 ton of ferronickel, with 10,482 ton of imports from New Caledonia, up nearly 3-folds to rank second, according to China Customs.

Chile’s copper exports down 24% in July

The latest statistics released by Chile’s central bank suggests significant drop in copper exports by the country during the month of July this year. Chile’s copper exports plunged nearly 24% year-on-year. The value of exports amounted to $2.398 billion during the month in comparison with the value of $3.171 billion during the same month a year before.

The sharp plunge in copper prices led to decline in copper exports by the country. The copper prices averaged at $2.48 per lb during July this year, almost 23% down when compared with $3.22 per lb during July 2014. The exports of cathode during the month dropped by nearly 19% to $1.102 billion, whereas the concentrate exports plunged heavily by 23% to $1.023 billion.

The cumulative copper exports by Chile during the initial seven-month period of the year amounted to $19.352 billion, down by 13% when compared with the previous year. The copper exports during January to July last year had totaled $22.244 billion. Exports of cathode dropped by 16% year-on-year to $8.796 billion, whereas those of concentrate declined by 6% to $8.898 billion.

The copper production by Chile is expected to total 5.8 million mt during the entire year 2015. Incidentally, Chile is the world’s largest copper producing nation.

Meantime, a report recently published by the Chilean Copper Commission (Cochilco) states that lack of up-to-date technology could lead to sharp decline in country’s copper production after 2025. According to the report, Chile may increase its copper output to almost 10 million mt by 2025, but several factors could lead to decline in output thereafter. The lack of new discoveries and complication in expansion of existing mines are cited as the key reasons behind the projected fall in copper output by Chile.

Sunday, August 9, 2015

The all-inclusive cost to produce gold is about $ 1,100

“Gold’s father is dirt, yet it regards itself as noble” So goes a Yiddish proverb. Trouble is, it has not lived up to the proverb’s meaning: gold, like other commodities, has taken a beating over the past month.

Unlike many commodities, it has few industrial uses. A big chunk of demand is for investment. Gold held in exchange traded funds — a typical investment instrument — has fallen 40 per cent since a 2012 peak.

The recent gold price fall means more trouble ahead for gold miners. The all-inclusive cost to produce gold is about $1,100. If gold prices fall below $1,000, some gold reserves (assets) would be unprofitable to recover and need to be written down, putting pressure on the more indebted miners.

Gold cannot fall forever. Even so, listed gold miners should at some point be cheap. One early buy signal is when it costs less to buy mines on the stock market than to build them. Building a gold mine from scratch can be measured, crudely, by the cost of the investment (including debt) an ounce of gold produced. An average new mine would cost $2,500 an ounce of annual output, estimates RBC. Yet the larger listed gold miners still have an average enterprise value to production of $3,600.

More traditional valuation metrics tell a similar story. Despite the precious metal’s fall, the two largest miners by market value, Barrick Gold and Newmont Mining, still trade at double their forward price earnings multiples of two years ago.

Even if gold prices keep falling, it is far too early to sift the dirt for glitter.

Thursday, August 6, 2015

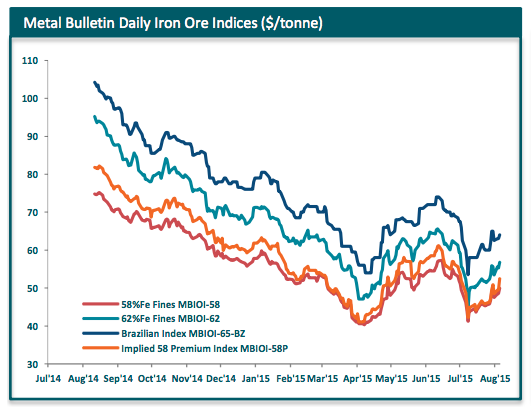

Iron ore price rally has legs

The price of iron ore jumped on Wednesday as the market for the steelmaking raw material in top consumer China picks up and traders square positions ahead of a public holiday in the Singapore hub.

The benchmark 62% Fe import price including freight and insurance at the Chinese port of Tianjin advanced $1.40 or 2.5% to $56.40 a tonne, according to data provided by The SteelIndex. That's up just under 28% from record lows hit July 8.

The advance in the Metal Bulletin's benchmark 62%-index at the ports of Qingdao-Rizhao-Lianyungang in China was $1.49 to $56.78 while lower grade 58% fines soared $2.91 a tonne to $52.46, a 5.9% gain on the day.

Chinese steel prices have come off one-month highs hit yesterday but at $337 a tonne the most-traded rebar contract on the Shanghai Futures Exchange is up sharply from a record low of $305 hit early July.

Platts News reports that some Chinese steel mills have begun to raise output on the back of the higher rebar and billet prices:

"Many mills near Beijing will be mandated to reduce their steel output so as to ensure a clear blue sky in the capital," the source said. "Mills in the south that not affected by the output cut are producing as much as possible so that they have steel products on hand to sell when steel prices are expected to hike by end of this month."

That blue sky would be courtesy of the Chinese government which has halted all construction inside the capital city and ordered steelmakers in areas surrounding to make drastic cuts in production and ahead of September 3 military parade marking the 70th anniversary of the end of World War II.

Not everyone is convinced that the rally in steel and iron has much further to go. One steel trader told Reuters that "some traders and mills are trying to sell more as buying isn't as strong as the rally in prices and they are worried that prices might have hit the ceiling at the moment."

A slowing economy and rapidly cooling property market have seen the country's steel consumption contract by 4.7% in the first six months of 2015 according to the country's Iron and Steel Association (CISA).

China forges almost as much steel as the rest of the world combined and the country sucks in more than 70% of the world's seaborne iron ore.

Sunday, August 2, 2015

LME Lead prices may drop to $1,670-1,680 a ton range next week

LME lead should weaken towards $1,670-1,680 a ton next week, SMM lead group foresees.

Base metals should continue to be depressed by China’s negative indicators and stronger dollar next week, boding ill for lead prices.

Longs for LME lead exit market, driving positions down. Technical indicators also show signs of falling.

SHFE 1510 lead may slip to RMB 12,800 a ton next week with strong resistance forming at RMB 13,000 a ton.

China spot lead is expected to range between RMB 13,100-13,300 a ton next week. Trades should pick up early August.

More lead smelters will resume operation but operating rate at motive battery makers will also increase due to battery price hikes.

Base metals should continue to be depressed by China’s negative indicators and stronger dollar next week, boding ill for lead prices.

Longs for LME lead exit market, driving positions down. Technical indicators also show signs of falling.

SHFE 1510 lead may slip to RMB 12,800 a ton next week with strong resistance forming at RMB 13,000 a ton.

China spot lead is expected to range between RMB 13,100-13,300 a ton next week. Trades should pick up early August.

More lead smelters will resume operation but operating rate at motive battery makers will also increase due to battery price hikes.

Subscribe to:

Posts (Atom)