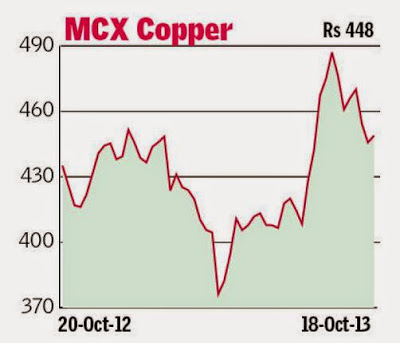

Copper (Rs 448.8): Failing to breach the resistance at Rs 460, the MCX contract reversed lower from the intra-week high of Rs 459.8. The contract can consolidate sideways in the range between Rs 440 and Rs 460 for some time. Within this range the bias is to see a bearish break and fall below Rs 440. This will take the contract lower to Rs 430 in the short-term.

The upside could be limited to Rs 470 if the contract breaks above Rs 460.

The medium-term outlook is also bearish. There is a strong resistance between Rs 460-470 that needs to be broken to reverse the bearish outlook. Below Rs 470, the contract is likely to fall to Rs 400-390 in the medium-term.

Crude oil (Rs 6,192): The intra-week bounce failed to breach the important resistance at Rs 6,300. The MCX crude oil has moved down from the high of Rs 6,348, to close lower for the seventh consecutive week. Below Rs 6,300, the short-term outlook is weak and it may test Rs 5,812 and Rs 5,855 levels which are the 200-day moving average and 61.8 per cent Fibonacci retracement support levels respectively. Even if the contract breaches the resistance at Rs 6,300, the upside will be limited to Rs 6,500.

The medium-term view is also bearish. Strong resistance is seen in Rs 6,500-6,600 zone. Below this resistance zone a fall to Rs 5,500-5,400 is possible in the medium-term.

Zinc (Rs 116.5): The MCX Zinc contract is consolidating sideways over the last few weeks. This sideways consolidation can continue for some more time and the price can remain in the Rs 113-120 range in the immediate short-term.

Within this range, the bias is towards a bearish trend and the contract can break below Rs 113 in the coming days. The immediate downside target below Rs 113 is Rs 110. An eventual break below Rs 110 can take the price lower to Rs 104.

For the medium-term, the contract has strong support near Rs 100. Above Rs 100, the medium-term outlook is bullish and the contract can trend upwards to test Rs 120-130 levels.

Natural gas (Rs 231.1): As predicted in this column last week, the MCX Natural Gas contract tested the resistance at Rs 240. It fell and closed flat for the week. Failure to breach above Rs 240 implies that the bearish outlook is intact for the short-term.

The contract can fall to Rs 220-210 in the coming weeks. However, the medium-term outlook is bullish as the contract remains in a bull channel. The channel support is near Rs 200 which can limit the downside. A fresh upmove from this support can take the price higher to Rs 260-270.

Lead (Rs 132.2): The sharp fall from the August peak at Rs 155.4, is taking support near Rs 125 over the last couple of weeks. Above Rs 125, the MCX Lead contract can see a corrective rally towards Rs 140-143 in the short-term.

However, a rise above Rs 143 might be difficult. On the other hand, if the price falls below Rs 125, the possibility of which is less at least in the immediate near term, then the contract can fall lower to Rs 120.

The medium-term outlook is bullish. Strong support is at Rs 110-100 levels. The contract may test this support zone, but a fall below Rs 100 is less likely. The contract can take support at this level and move to Rs 160 in the medium-term.