The MCX gold futures contract has risen sharply by 8.3 per cent over the last two weeks. A 6.3-per cent recovery in the global gold price over the last two weeks following the weaker dollar has supported MCX futures contract price. The short-term outlook for the MCX gold futures contract is positive. Support is available at Rs 29,500 and the contract can rise further to test Rs 31,500-31,700 levels in the coming weeks. Important short-term resistances to be watched are Rs 30,900 and Rs 31,697. For the medium-term, Rs 32,500 is a crucial resistance level. Failure to breach this resistance will keep the price pressured to test Rs 25,500-25,000.

Silver (Rs 49,709)

The MCX silver is now witnessing a corrective rally and has risen six per cent in the last two weeks. Significant short-term supports are available at Rs 48,500 and at Rs 47,500. Above these supports, the corrective rally can extend further in the coming week targeting Rs 51,000-51,500 levels.

However, the medium-term outlook is bearish. Strong resistance is there in the broad Rs 52,000-53,000 region. The contract needs to breach the Rs 53,000 resistance decisively to turn the outlook bullish. Failure to break above Rs 53,000 will keep the medium-term bearish outlook intact for a fall to Rs 41,500-40,500 levels.

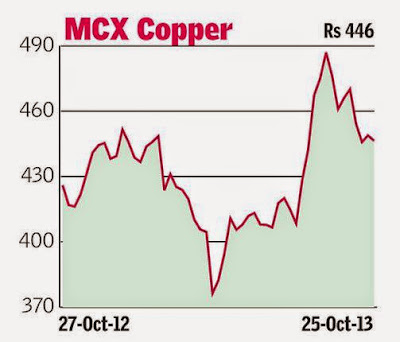

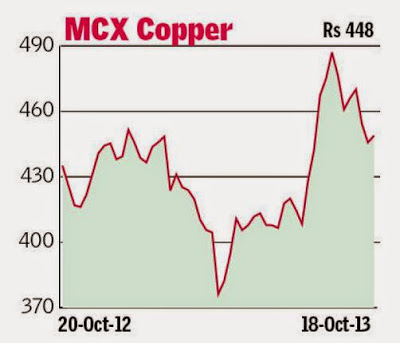

Copper (Rs 446.4)

MCX copper futures contract is stuck in a sideways range between Rs 440 and Rs 460. The price can continue to consolidate in this range for some more time. Within this range, the bias is bearish. The contract can break and fall below Rs 440 towards Rs 430-425 in the short-term. The medium-term outlook is also bearish with strong resistance at Rs 470. While below this resistance, the contract can fall to Rs 400-390 in the medium-term.

Crude oil (Rs 6,045)

The MCX crude oil futures contract is in a strong downtrend now. The contract has closed 2.4 per cent lower for the week, its eighth consecutive lower weekly close. Sharp fall in the global crude oil price is keeping the MCX futures contract under pressure. Immediate resistance is at Rs 6,100 and then significant resistances are at Rs 6,200 and at Rs 6,300. While below Rs 6,300, the contract can fall to test Rs 5,855 and Rs 5,835.

The medium-term outlook is also bearish and the contract can fall to Rs 5,500-5,400. Strong resistance is at Rs 6,600 which needs to be broken to reverse the current downtrend.

Natural gas (Rs 227.3)

The MCX natural gas contract has been trading sideways between Rs 215 and Rs 240 in the last few weeks. A breakout on either side of Rs 215-240 will decide the trend, going forward. Below Rs 240, the trend is bearish and the contract may slide further to Rs 210 and Rs 205 in the short-term.

However, the medium-term outlook is bullish. The contract is trading in a bull channel with strong support at Rs 200. A break below Rs 200 might not be very easy and the contract can rise higher to Rs 260-270 from this support level.