Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Showing posts with label COMMODITIES. Show all posts

Showing posts with label COMMODITIES. Show all posts

Monday, April 21, 2014

The robot is ready - so when will deep sea mining start ?

* Most potential subsea minerals in international waters

* U.N. body expects mining code in 2-3 years

* Canadian company ready to mine off Papua New Guinea

By Stephen Eisenhammer and Silvia Antonioli

NEWCASTLE, England/LONDON, April 18 (Reuters) - The world's first deep sea mining robot sits idle on a British factory floor, waiting to claw up high grade copper and gold from the seabed off Papua New Guinea (PNG) - when a wrangle over terms is solved.

Beyond PNG, in international waters, regulation and royalty terms for mining the planet's subsea wealth have also yet to be finalised. The world waits for the judgement of a United Nations agency based in Jamaica.

"If we can take care of the environment we have a brand new day ahead of us. The marine area beyond national jurisdiction is 50 percent of the Ocean," said Nii Odunton, secretary general of the U.N.'s International Seabed Authority (ISA).

"I believe the grades look good, the abundance looks good, I believe that money will be made," Odunton said from the ISA offices in Kingston.

High-tech advances, depleted easy-to-reach minerals onshore and historically high prices have boosted the idea of mining offshore, where metals can be fifteen times the quality of land deposits.

In Newcastle, the "beasty", as engineer Keith Franklin calls his machine, lies in wait, resembling a submersible tank with four metre wide cutting blades.

Built by Soil Machine Dynamics (SMD), it will put Canadian listed Nautilus Minerals on course to become the first company to commercially mine in deep water.

Nautilus' primary resource, Solwara 1, about 1,500 metres underwater, is a Seafloor Massive Sulphide (SMS) deposit, which forms along hydrothermal vents where mineral-rich fluids spurt from cracks in the ocean crust.

Equipped with cameras and 3D sonar sensors the robot is driven by two pilots from a control room on the vessel above, attached via a giant power cable.

"The cameras aren't enough by themselves because the machine will be working by vents where black soot spurts from the ocean crust and it will sometimes be near impossible to see anything," said Stef Kapusniak, business development manager for mining at SMD. "The 3D sonar will allow it to make images and send it back to the control room."

The machine then cuts up the sea floor and sucks the rocks through a pipe to deposit it in mounds behind - "like icing a cake," Kapusniak said. Another machine, yet to be built, will then help suck the ore to the surface.

Nautilus aims to produce 80,000-100,000 tonnes of copper and 100,000-200,000 ounces of gold - equivalent to a modest onshore mine. It was supposed to be producing by now, but disagreements with the PNG government over financial terms have set it back.

Chief Executive Mike Johnston told Reuters he was confident a resolution would be sorted out and the company would be mining within two to three years.

Most of the world's best deposits lie even deeper than Nautilus' Solwara 1, at around 6,000 metres in an area known as the Clarion Clipperton Zone.

Large numbers of manganese nodules - potato sized rocks rich in copper, cobalt and nickel - lie across this 4.5 million square kilometre abyssal plain between Hawaii and Mexico.

LICENSES ALREADY AWARDED

The U.N.'s ISA is drawing up a code to deal with some environmental concerns and the commercial terms for deep-sea mining. It predicts it will be finished in around two or three years, with mining still 5-10 years away.

"It's only after the code is in place and people are happy with it that the huge investments needed to start deep-sea mining will occur," ISA's Odunton, a Ghanaian, said.

ISA is, however, already doling out exploration licenses - 19 have been approved. Odunton said interest in them had "catapulted" in the past five years.

In order to get a licence through ISA an applicant must be sponsored or partnered with a country. For nations like Japan which lack their own resource wealth, deep-sea mining is a potential way to secure mineral supply for the future.

China, the world's largest metals consumers, is also one of the most active in exploring the area.

Britain has an exploration licence in partnership with UK Seabed Resources, a subsidiary of defence firm Lockheed Martin .

"These are the days you have to take a position, especially as a government," said Martijn Schouten, managing director at IHC's mining division - an equipment maker which targets seabed mining as its next growth driver.

IHC is the leading partner in an European Union funded project called Blue Mining, begun in February, and will look at the business case and technology for deep-sea mining over the next four years.

This new frontier is an exciting prospect for developing island nations like Tonga and Nauru, which both have exploration licences. For Tonga, where Nautilus says it has been collecting encouraging exploration results, it could be a game changer.

"The revenue stream and taxes from a medium sized mine would have an enormous benefit to the country," Nautilus' Johnston said.

The main companies looking to mine the seabed, like Nautilus and UK Seabed Resources, are not, however, traditional mining firms, although Anglo American does have a 5 percent stake in the former.

IHC said most of its contracts were with technology-based companies that were not in the mining industry, although it would not specify further due to confidentiality clauses.

IHC said it has had discussions with oil majors who are beginning to show an interest in deep sea mining.

But, with little of the deep ocean mapped or explored, environmentalists worry about the potential loss of fauna and biospheres whose existence is not yet understood.

"Only 3 percent of the oceans are protected and less than 1 percent of the high seas, making them some of the least protected places on earth. The emerging threat of seabed mining is an urgent wake-up call," Greenpeace said in a report last year.

"I think we really have to be careful about what happens to the environment," said ISA's Odunton. "We don't know enough to take some of the risks we've taken on land."

Wednesday, April 2, 2014

Best And Worst Performers In March And Q1

Wednesday, March 5, 2014

Recent Russia-Ukraine crisis may impact several commodities

The political tensions surrounding Russia and Ukraine have potential to impact markets for a number of commodities, said Deutsche Bank in a snippet.

According to the German Bank, exports of commodities account for around half of Ukraine’s gross domestic product. Key commodity exports include agriculture, chemicals, metals and timber.

Meanwhile, Europe depends on Russia for about 30% of its gas supply. Deutsche Bank points out that gold has benefited from safe-haven flows due to the crisis.

“If there are international efforts to impose sanctions on Russia, then this could start to impact the PGM (platinum group metals) sector and specifically palladium given Russia is the world’s largest producer of palladium and given its large holdings of above-ground stocks,” said the analysts at Deutsche Bank, via Kitco News. “Nickel, oil and aluminum could also be affected.”

“However, of the major metals aluminum is probably the most oversupplied which may limit price implications from any sanction induced supply disruption,” Deutsche Bank added.

Sunday, December 29, 2013

Gold & Silver Are Jumping And WTI Crude Breaks $100

Tuesday, December 3, 2013

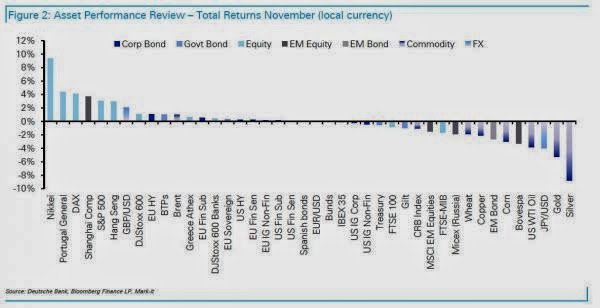

The Best And Worst Performing Assets From November.

Monday, December 2, 2013

Commodity markets to see subdued activity.

As the world moves towards the end of 2013, some of the uncertainties facing the global economy have turned less-pronounced. Global growth signals are picking up momentum and fiscal headwinds are moderating with many analysts looking for stronger growth in the US and Europe during 2014. Geopolitical tensions have somewhat eased with the announcement of an interim deal with Iran.

As the world moves towards the end of 2013, some of the uncertainties facing the global economy have turned less-pronounced. Global growth signals are picking up momentum and fiscal headwinds are moderating with many analysts looking for stronger growth in the US and Europe during 2014. Geopolitical tensions have somewhat eased with the announcement of an interim deal with Iran.

On monetary policy, especially the US Fed tapering, it is clearer than before that reduction in asset purchase would begin at the earliest. This week’s key data focus will be on the US labour report. But even before the turn of events, in recent months, commodities as an asset class have not been the most favourite. Investor appetite has been weak. Return on investment has been far from attractive.

With winter and holidays looming, in the next couple of months commodity markets will witness subdued activity. Improving equity market sentiment and firming dollar will pressure commodities down in general and gold in particular.

Last week in London, metal prices were generally weak. Precious metals were mixed with platinum losing 1.4 per cent over the week while gold and palladium edged up by 0.5 per cent and 0.4 per cent respectively. Silver stayed unchanged. Among base metals, LME cash aluminium came under pressure and shed 1.6 per cent in value over the week, followed by lead (-1.5 per cent). Others edged lower. Oil WTI was down 1.4 per cent after the agreement with Iran.

DULL GOLD

With the dollar firming against the euro and equity markets retaining their strength, gold prices have been under pressure. The metal failed to find support from the October FOMC minutes and dipped below $1,250 an ounce.

Indeed, in November, prices fell by over 5 per cent and year-on-year fell more than 25 per cent. Investor appetite is weak and physical demand looks enervated despite recent price falls and seasonal factors. ETP outflows have been heavy and are currently the holdings are below 2,000 tonnes, a new low since 2010.

On the other hand, silver has become even more vulnerable when seen year on year. Its Friday London close of a tad below $20/oz reflects a 40 per cent decline from $34 in November 2012.

On Friday, in London, all precious metals moved up erasing some of the losses of previous trading sessions. Gold PM fix was $1,253, higher than the previous day’s $1,246. Silver AM fix was $19.93 versus the previous day’s $19.76. Platinum ended at $1,376 ($1,357) and palladium $724 ($717).

A delay in tapering has only provided a temporary respite for the yellow metal. Bearish fundamentals, unhelpful currency , weak physical demand and lack of investor appetite have combined. Should prices breach $1,200 mark (which looks absolutely possible), the weakness is likely to be exacerbated given that additional holding in the physically-backed ETPs will become loss-making and outflows will accelerate.

Is there a silver lining to the otherwise poor sentiment in the gold market? Yes, there is. China is buying huge quantities of gold from Hong Kong. China’s imports have accelerated in the last ten years. Although currently month on month imports figures look erratic, the pattern is unmistakable. Based on customs data, it is estimated that January-October imports were nearly 950 tonnes, raising the prospects of annual imports breaching the 1,000-tonne mark. With the recent price fall in dollar terms, China’s imports have become heavier.

METALS MIXED

On Friday, LME cash copper closed at $7,054/tonne, aluminium at $1,710 and lead $2,055. One of the big surprises of this year has been copper.

According to International Copper Study Group, there has been a 6 per cent rise in refined production. However, analysts point out that visible inventories are declining. As regards aluminium the market could get into deficit in 2014 after several years of structural oversupply. Decline in nickel and aluminium prices over the past week looks overdone, according to experts who point out to the potentially significant supply risks from Indonesia.

CRUDE MAY SLIP

While the interim agreement with Iran on its nuclear program holds out the promise of a solution to one of the key issues affecting not only crude oil supply but also the broader instability in West Asia, the road ahead is likely to be long and arduous.

Thursday, November 7, 2013

Commodities rally unlikely to sustain in Q4

Ongoing uncertainties over economic growth, monetary policy, geopolitics and currency gyrations continue to buffet the global commodity markets even as commodities respond to these in several ways. The last quarter witnessed a broad-based recovery in spot prices of commodities such as crude because of supply disruption and in gold and copper because of short-covering. Will the price rally sustain over Q4? It looks most unlikely on current reckoning given the still muted global growth environment and strong possibility of the beginning of a progressive end to the US easy money policy in the months ahead.

Ongoing uncertainties over economic growth, monetary policy, geopolitics and currency gyrations continue to buffet the global commodity markets even as commodities respond to these in several ways. The last quarter witnessed a broad-based recovery in spot prices of commodities such as crude because of supply disruption and in gold and copper because of short-covering. Will the price rally sustain over Q4? It looks most unlikely on current reckoning given the still muted global growth environment and strong possibility of the beginning of a progressive end to the US easy money policy in the months ahead.

Last week, commodity prices faced significant downward pressure. It was the result of less-dovish-than-expected FOMC meeting and a firming dollar (1.35) against the euro to two-week highs. Importantly, ISM data suggested the US manufacturing sector shrugged off the government shutdown in October. Analysts interpreted this as continued weakening of confidence in the Fed’s resolve to maintain QE.

The big suspense is whether tapering will be announced in the December meeting. It is clear that the decision is data dependent. While a decision in December remains a possibility, many analysts believe flow of stronger data (mainly employment) is necessary to support Fed reduction in the pace of asset purchase. That can potentially happen by March 2014. In other words, liquidity will continue to drive the market for another 3-4 months. Seasonally, commodities in general tend to suffer in November led lower by the energy complex.

Last week, the Dow Jones-UBS commodity index announced new weights. It is expected that funds linked to it will be buyers of silver, gold, corn and soybean oil and sellers of natural gas and cotton, according to expert opinion. Some analysts have revised modestly upward their 2013 Q4 and 2014 price forecast for copper due to production problems and strong Chinese demand. However, it is also true that if China buys more now, it may need less later. Supply risks to platinum from South Africa are seen mounting.

Gold: The recent rally seen in gold may be petering out if events last week are any indication. Macro data are supportive, raising the probability of a tapering decision in December itself. Gold ETP outflows resumed with net redemption reaching 47 tonnes, more than the total outflows of last two months. Total metal held in trust has reached a fresh May 2010 low.

To be sure, gold drivers have all weakened. The dollar is firming. The metal has not reacted to the US debt dispute. Investor support is enervated. On the other hand, the seasonal Indian demand has remained rather weak which exposes the yellow metal to a fragile floor. Anecdotal reports from the world’s largest importer-consumer India suggest muted festival buying interest. Jewellery sales are down. High price, general inflation and expectation of a fall in price have forced buyers to turn cautious. With demand side unhelpful, no wonder, longs are exiting their speculative position. The only support factor seems to be Chinese demand; but indications of some tightening in China’s monetary policy may potentially impact.

Technically, gold momentum has turned weak. Resistance is seen at 1345 and 1330 while support may be available at 1290 and 1270. As the USD strengthens and yields tick higher, gold rolls over, risking a return to 1250/70 before a bounce.

Base metals: China continues to be the dominant factor to impact the complex. A combination of stronger economic activity, concerns over future raw material availability, increased capacity and lower prices have been driving a Chinese base metals buying spree over the past few months, explained an analyst adding helpfully that increased industrial activity has boosted consumption while expanded capacity means more working inventory is needed. Simply put, Chinese base metals stocking cycle is in full swing.

Current heavy purchases mean there is risk the Asian major may not buy as much later. This can potentially create price risk, especially in 2014. In the short-run however, the tighter-than-expected market balances create some upside potential for prices. Some analysts have raised their 2014 nickel price forecast up to $ 15,000/t (from $ 14,000/t) as low prices have triggered production cuts, shrinking the forecast 2014 surplus. In case of aluminium, the market in 2014 is likely to turn to a small deficit for the first time in nine years.

Crude: Although there are many swing factors, the directional bias for prices is slightly to the downside from current levels. The strength in oil markets that characterized Q3 is dissipating. In Q4, Brent price is forecast by analysts to average $ 105 a barrel with limited movement upward.

Monday, September 23, 2013

Commodities prices to take a hit when US tapering begins.

Prices of commodities could head south as soon as the US Federal Reserve begins to cut its $85 billion-a-month stimulus programme as hedge funds and money managers will cash out, a global seminar on edible oils was told on Saturday. “Currently, interest rates are near zero and at the bottom. But once the tapering happens and the interestrates go up, money managers and hedge funds will switch over to other gainful investments such as bonds,” said James Fry, Chairman, LMC International, London.

“It is a bad decision on the part of the US Fed not to taper its stimulus plan. Sooner or later, it has to begin and it will suck out the liquidity in the commodities market,” said Dorab Mistry, Director of Godrej International.

“Returns have to be higher than the rate of inflation. Therefore, bonds will tend to give higher returns. All those people who have found value in commodities will switch over,” Fry said on the sidelines of Globoil India 2013.

BIO-FUEL USE

Earlier, in his address at the business session, Fry said that currently, crude palm oil was being supported in South-East Asia, particularly Indonesia, through use as bio-fuel. “The use of palm oil as bio-fuel is helping it to rule at a small premium over Brent crude in Europe, though in Asia, it is at a discount to the latter,” he said.

Indonesia has announced plans to produce 3 million tonnes of bio-diesel next year and in 2015. This could provide support to prices of palm oil and other vegetable oils.

However, things could change if Brent crude oil prices drop.

“There are a few pointers to why crude oil prices will come under pressure.

The US is adding a million barrels to its supplies every year and shale gas is emerging as a real threat,” the expert said.

SHALE CONVERSION

Currently, the cost of producing shale gas equivalent to a barrel of crude works out to $20 in the US and $50 in Europe.

“There are plants coming up to convert shale gas into required fuel,” said Fry, adding that interest in using bio-fuel in the US and the EU is waning.

With palm oil heading for peak production season, its stocks could rise to 2.2 million tonnes by November-end and it would not reach last year’s level of 2.6 million tonnes.

Crude palm oil could rule between MYR 2,250 ($710) and MYR 2,500 ($790) a tonne towards the year-end, while rapeseed, sunflower and soya bean oils could drop to lower than $1,000.

Meanwhile, during a price outlook session at the meet, soya bean production in the country was estimated between 110 lakh tonnes and 140 lakh tonnes.

While some experts put it at the lower end, others such as Atul Chaturvedi, CEO, Adani Wilmar, pegged it at the higher end.

Soya bean oil prices could drop by Rs 20-40 for 10 kg, while soyameal prices could also fall to levels of Rs 31,000 before the year-end.

“Once the tapering happens and interest rates go up, money managers and hedge funds will switch over to other gainful investments such as bonds,” said James Fry, Chairman, LMC International, London.

Subscribe to:

Posts (Atom)