Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Friday, November 14, 2014

Oil Plunges As Saudis Dismiss Price War "No Basis In Reality"

WTI Crude oil prices tumbled to a $75 handle this morning as Saudi oil minister al-Naimi dismissed claims of a price-war as having "no basis in reality" noting that "Saudi oil policy has remained constant for the past few decades and it has not change today," suggesting expectations of a supply cut at the looming OPEC meetings are overdone. This comment comes after Qatar said it "may" cut output by 500k barrels/day.

As Bloomberg reports,

Saudi Arabia’s oil minister dismissed talk of a price war as having “no basis in reality” in his first public comments since crude plunged into a bear market last month.“Saudi oil policy has remained constant for the past few decades and it has not changed today,” Ali al-Naimi said at a conference in Acapulco, Mexico, yesterday. “We want stable oil markets and steady prices, because this is good for producers, consumers and investors.”“Talk of a price war is a sign of misunderstanding -- deliberate or otherwise -- and has no basis in reality,” al-Naimi said at a natural gas forum. “Saudi Aramco prices oil according to sound marketing procedures -- no more, no less.”

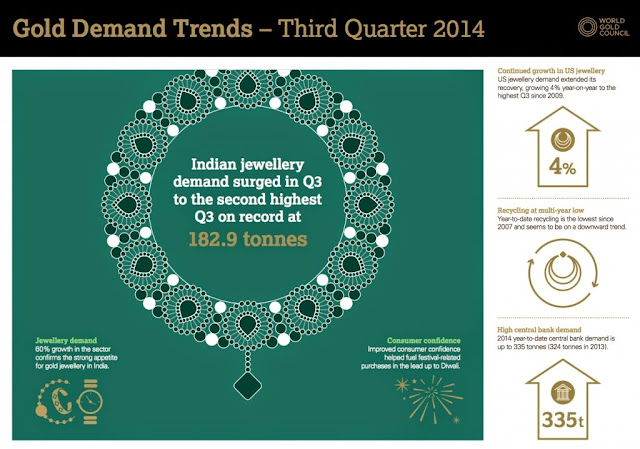

India back to being world’s top gold consumer

India reclaimed its world’s top gold consumer crown from China as demand for jewellery surged almost 60% in the third quarter of the year, fresh data from the World Gold Council (WGC) shows.

Global demand, however, fell to its lowest in nearly five years as Chinese buying slid by a third and gold jewellery, the biggest single area of consumption, dropped 4% to 534 tonnes.

Overall, the south Asian nation —which had lost his position as the world’s No.1 gold consumer to China in 2011—bought 39% more gold in the run-up to Diwali and the start of the traditional wedding season.

The WGC said that a weakening of gold prices in rupee terms had boosted demand in India, and that confidence in the new government led by Narendra Modi had also contributed to the rise.

The increase in Indian purchases is more marked because demand for gold in the same period in 2013 was particularly weak, due to government restrictions on gold imports designed to limit the country's current account deficit.

“It is now beyond debate that import restrictions have had little impact on the demand for gold and yet have strengthened the unauthorized supply channels,” according to WGC India’s Managing Director P.R. Somasundaram.

Gold smuggling into India has skyrocketed since the government ratcheted up restrictions and taxes on legitimate imports of the precious metal. According to the council, about 200 tons of gold came through unofficial route last year and a similar quantity is also expected this year.

WGC Managing director of investment strategy Marcus Grubb noted the fiures for India and China this quarter reinforce the need to understand the factors which underpinned an "exceptional Q3" last year.

"People around the world buy gold for different reasons at different times, reinforcing the unique self balancing nature of the gold market. With recycling at a seven year low and mine supply looking increasingly likely to be constrained in the future the outlook for physical gold demand remains strong,” he said in today's statement.

Key findings from the report:· Jewellery remains the biggest component of gold demand, representing more than half of all demand at 534t, which is 4% lower year on year. Jewellery demand was driven by India, which increased 60% to 183t. UK and US demand was also strong. Chinese jewellery demand fell 39% to 147t as the jewellery market caught its breath after an exceptional year for demand last year.· Central banks bought 93t of gold in Q3 2014, 9% lower year on year, but the 15thconsecutive quarter that banks were net purchasers of gold.· Investment demand (bars and coins and ETFs) was up 6% to 204t. However, there was a 21% fall in bar and coin demand from 312t to 246t following unprecedented levels of demand last year. ETF outflows stood at 41t compared to 120t in the same period last year.· Technology demand was 98t, 5% lower than a year ago as the industry continued its shift towards alternative materials in technological applications.· Total supply fell by 7% year on year to 1,048t. Mine production was up slightly 1% to 812t, but recycling of gold continued to abate, declining 25% year on year to 250t, and on a year to date basis is the lowest level since 2007.

Thursday, November 13, 2014

Bank of America Merrill Lynch sees Copper to avg $6,939/MT in 2015

Bank of America Merrill Lynch looks for copper prices to average $6,939 a metric ton during 2015 and the red metal demand to expand 4.1% in 2015.

According to BAML, there are signs of global economic growth stabilizing, led by emerging markets, including China. Europe is also steadying, while the U.S. and U.K. have held up.

Considering BAML core view that copper is a trade on global rather than just Chinese growth, we believe the macroeconomic backdrop should be supportive to prices into the first quarter.

In China, an end to destocking in the private sector should push imports above the levels seen during the summer. And, while analysts look for increases in mine supply, BAML does not expect this to be enough to cause a glut.

The biggest percentage increase in concentrates occurred in 2013 and is always long behind us. BAML looks for a supply surplus of 101,000 metric tons this year, declining to just 15,000 tons in 2015.

“Putting it all together, we believe that copper is unlikely to break out of recent ranges, yet we advocate a tactical long position in copper as recent apprehension over the global macro economy and China subsides moving into 2015,” analyst with BAML added.

Wednesday, November 12, 2014

Zinc gains on supply concerns, dip in dollar

* China zinc market shows signs of supply tightness

* Dollar weakens against currency basket, supports metals

(Reuters) - Zinc prices rose on Tuesday, supported by a strike at a Peruvian mine, concerns over expected tight supplies and a slightly weaker dollar.

London Metal Exchange data showed zinc inventories declined by 2,050 tonnes to 691,725 tonnes on Monday, extending two months of almost daily falls.

Also, workers at Peru's Antamina mine, its largest for both zinc and copper , began an indefinite strike.

Supporting metals markets, the dollar dipped against a basket of currencies, making dollar-priced copper and other metals cheaper for non-U.S. buyers.

"The mine supply side for zinc is going to be tight next year but more recently smelter output expectations in China have become more muted. We see zinc prices averaging above $2,300 a tonne next year," Macquarie analyst Vivienne Lloyd said.

Three-month LME zinc closed up 1.1 percent at $2,269 a tonne. Zinc prices are up about 10 percent this year on expectations of a deficit.

In China, ShFE zinc stocks fell by a fifth on Friday to five-year lows of 111,761 tonnes, while ShFE cash prices have traded at a premium against third-month prices.

In other metals, LME copper ended 0.5 percent firmer at $6,692 a tonne. Copper prices have fallen 10 percent this year.

Chile's Codelco, the world's top copper producer, has lowered its term premium by 3.6 percent to $133 a tonne for 2015 term shipments of the metal to China. The premium is in step with the Chinese spot market, where the surcharge has more than halved this year.

Monday, November 10, 2014

Russia, China Sign Second Mega-Gas Deal: Beijing Becomes Largest Buyer Of Russian Gas

As we previewed on Friday, when we reported that "Russia Nears Completion Of Second "Holy Grail" Gas Deal With China", moments ago during the Asia-Pacific Economic Cooperation forum taking place this weekend in Beijing, Russia and China signed 17 documents Sunday, greenlighting a second "mega" Russian natural gas to China via the so-called "western" or "Altay" route, which as previously reported, would supply 30 billion cubic meters (bcm) of gas a year to China.

Among the documents signed between Russian President Vladimir Putin and Chinese leader Xi Jinping were the memorandum on the delivery of Russian natural gas to China via the western route, the framework agreement on gas supplies between Russia's Gazprom and China's CNPC and the memorandum of understanding between the Russian energy giant and the Chinese state-owned oil and gas corporation.

“We have reached an understanding in principle concerning the opening of the western route,” Putin said. “We have already agreed on many technical and commercial aspects of this project, laying a good basis for reaching final arrangements.”

RIA adds, citing Gazprom CEO Alexei Miller, that the documents signed by Russia and China on Sunday define the western route as a priority project for the gas cooperation between the two countries.

"First of all these documents stipulate that the "western route" is becoming a priority project for our gas cooperation," Miller said, adding that the documents provide for the export of 30 billion cubic meters of Russian gas to China annually for a 30-year period.

Miller noted that with the increase of deliveries via the western route, the total volume of Russian gas deliveries to China may exceed the current levels of export to Europe in the medium-term perspective. In other words, China has now eclipsed Europe as Russia's biggest, and most strategic natural gas client. More:

Miller, who heads Russia's state-run energy giant, told reporters that "taking into account the increase in deliveries via 'western route,' the volume of supplied [natural gas] to China could exceed European exports in the mid-term perspective."This came after Russian and Chinese energy executives signed on Sunday a package of 17 documents, including a framework deal between Gazprom and China's energy giant CNPC to deliver gas to China via the western route pipeline.Miller said Gazprom and CNPC were in talks on a memorandum of understanding that would see Russia bring gas to China through the western route pipeline, as well as a framework agreement between the two state-owned companies to carry out the deliveries.

The western route will connect fields in western Siberia with northwest China through the Altai Republic. Second and third sections may be added to the pipeline at a later date, bringing its capacity up to 100 billion cubic meters a year.

The facts and figures of the Altay deal are broken down in the following map courtesy of RT:

Also of note, among the business issues discussed by Putin and Xi at their fifth meeting this year was the possibility of payment in Chinese yuan, including for defense deals military, Russian presidential spokesman Dmitry Peskov was cited as saying by RIA Novosti. More from RIA:

Russia's President Vladimir Putin and China's President Xi Jinping have discussed the possibility of using the yuan in mutual transactions in different fields of cooperation, Kremlin spokesman Dmitry Peskov said Sunday."Much attention has been paid to the topic of mutual payments in diverse fields ... in yuans which will help to strengthen the yuan as the region's reserve currency," Peskov said commenting on the meeting held between Putin and Xi on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in Beijing.On October 13, Russian Economic Development Minister Alexei Ulyukayev announced that Russia was considering Chinese market to partially substitute access to the financial resources of the European Union and the United States.The European Union and the United States have imposed several rounds of economic sanctions on Russia over its alleged involvement in the Ukrainian crisis, a claim Moscow has repeatedly denied. The restrictions prohibit major Russian companies from seeking financing on western capital markets.

Meanwhile, as China and Russia keep forging ahead in a world in which the two becomes tied ever closer in a symtiotic, dollar-free relationship, this is how the US is faring at the same meeting: "China, U.S. Parry Over Preferred Trade Pacts at APEC: Little Progress Made on Separate Trade Deals at Asia-Pacific Economic Cooperation Forum."

The U.S. blocked China’s initiatives because it worried that launching FTAAP talks would impede progress on a separate trade deal, the Trans-Pacific Partnership. The ministers’ statement said that any FTAAP deal would build on “ongoing regional undertakings”—a reference to TPP and other regional trade deals.“The Chinese got all they could expect—a reaffirmation that we all share in the vision of having a regional integrated model” for trade, said U.S. Chamber of Commerce Executive Vice President Myron Brilliant.U.S. Secretary of State John Kerry said Saturday that negotiating the TPP “is a battle that we absolutely must win.” Ministers from the 12 TPP nations met Saturday afternoon to try to narrow differences, including disputes between the U.S. and Japan over agriculture and auto trade. On Monday, the leaders of the TPP nations are again scheduled to discuss the trade deal, although no breakthrough is expected.The U.S. is trying to tie an ITA deal to progress on other trade deals with China, as a way to increase its leverage with Beijing. “How the ITA negotiations proceed is an important and useful data point” on China’s ability to negotiate an investment treaty with the U.S., Mr. Froman said.Trade analysts say the U.S. also hopes to use China’s desire to have the Beijing conference produce concrete results as leverage. This is the first major international summit held in China since Xi Jinping took over as Communist Party chief in 2012, and the government wants to use the session to affirm China’s greater role in the world.

Good luck trying to "increase US leverage with Beijing" using a trade conference being held in Beijing as the venue.

In other words instead of actual trade agreements, the US merely jawboned and "shared visions."

Then again, as noted here since 2010, in a world in which one can merely "print one's way to prosperity", what is the need for actual trade? Surely, which China and Russia are expanding their commercial ties at the expense of Europe, the US can continue to pretend it is the world's only superpower and has no need for either Russia or China. After all, Mr. Chairmanwoman can always go back to work and print some more of that "world reserve currency."

What The Swiss Gold Referendum Means For Gold Demand

The referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war - between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People's Party (SVP) on the other - has begun and we expect it to escalate as the day draws ever nearer. Having already questioned the 'location, location, location' of Switzerland's current gold stash, and examined the initiative in great depth here, JPMorgan notes that not only might the forthcoming Swiss gold referendum stabilize gold prices at a time when Gold ETF demand continues to decline, but warns, it also appears that markets under-appreciate this event.

As JPMorgan explains,

Gold ETF flows continued to bleed losing $4bn or 6% of AUM cumulatively since the end of August.

As JPMorgan explains,

Gold ETF flows continued to bleed losing $4bn or 6% of AUM cumulatively since the end of August.

Gold Miners ETFs, which have held up relative well up until recently also suffered over the past two weeks (Figure 7).

The downtrend in Gold ETF flows represents a headwind for gold in the face of subdued physical demand recently.

The latest data from China Gold Association, reported physical gold demand by Chinese investors of only 185 tonnes in Q3, down from 246 in Q2 and 322 in Q1.

While Chinese physical demand remains subdued...

[ZH - a point we note is very much in the eye of the newspaper holder]Who do you choose to believe?h/t @sobata416* * *

The forthcoming Swiss gold referendum could stabilize gold prices at a time when Gold ETF demand continues to decline.

It also appears that markets under appreciate this event.If the referendum is passed, the Swiss National Bank (SNB) will be forced to increase reserves by around 1,500 tonnes over five years, i.e. 300 tonnes per year.This 300 tonnes per year accounts for 7.5% of annual gold demand of 4,000 tonnes per year.

* * *

As Grant Williams noted previously, with the establishment being unable to actively campaign AGAINST the Initiative, all has been quiet for many months; but with the dawning awareness that this little campaign might actually grow some legs, a few members of that establishment have been getting a little antsy...

(Centralbanking.com): ...Now, with less than two months until the vote, the central bank is intensifying its communication. It opened a “dossier” on its website yesterday where it will post materials outlining why it “reject[s] the initiative”.“Monetary policy transactions directly change our balance sheet. Restrictions on the composition of the balance sheet therefore restrict our monetary policy options,” [SNB Vice-chairman Jean-Pierre] Danthine explained.“A telling example is our decision to implement the exchange rate floor vis-à-vis the euro... with the initiative’s legal limitation in place, we would have been forced during our defence of the minimum exchange rate not only to buy euros but also to buy gold in large quantities.“Our defence of the minimum exchange rate would thus have involved huge costs, which would almost certainly have caused foreign exchange markets to doubt our resolve to enforce the rate by all means.”

Sometimes I think these people are completely delusional.

So, let me get this straight: gold is a relic which restricts your ability to do such vital things as... oh, I dunno, promise to print unlimited amounts of your currency in order to peg it to another, failing currency and thereby debase it by 9% in 15 minutes? Or it might mean the market doesn’t have complete faith that you might be completely relied upon to do really smart things like that?

Disaster!

Somebody. Please? Make it stop.

The Swiss establishment has been reliant upon the public’s ignorance in these matters, but now they are up against a formidable opponent in Egon von Greyerz. Not only that, but they can clearly see that, as elsewhere around the world, the public is fast becoming disenchanted with the status quo; and that is potentially very dangerous for these people.

What is important to understand here is that if the initiative passes it will be part of the Swiss constitution IMMEDIATELY — not in two years, as many blogs and websites are suggesting. This means that the government and parliament cannot touch it. Only another referendum can change it. This is proper democracy for you.

The closer we get to the vote on November 30, the bigger this story is going to become, and the bigger it becomes, the higher the chance that the yes vote wins.

Should that happen, it will undoubtedly set off alarm bells throughout the gold market, as yet more physical gold will need to be repatriated and another sizeable, price-insensitive buyer will enter the marketplace.

Subscribe to:

Posts (Atom)