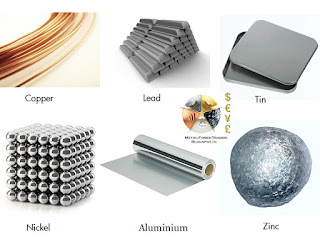

Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Saturday, January 9, 2016

Wednesday, January 6, 2016

What Comes After The Commodities Bust?

The days of E&P companies using external debt financing to fuel growth have most likely come to a close.

The one thing executives should have learned in 2015 is that Wall Street can for long periods of time remain disconnected from fundamentals and can swing to extremes. Another lesson from 2015 is that OPEC can no longer be relied upon to set prices.

Thus, the debt fueled financing boom in the shale space will most likely never return.

As a result, the industry will likely move to self-funding capital expenditures through free cash flow generation in an attempt to significantly reduce its reliance on leverage. Debt levels will initially have to be reduced, significantly fueling a cycle of dramatically lower capital expenditures and consolidation. This process is already underway, but still has a long way to go.

When the internet bubble burst in 2001, only the business models that generated cash vs subscriber growth and cash burn survived and continued to get funded. Furthermore, larger companies survived and thrived as the smaller ones got starved for cash, died or dramatically scaled back subscriber acquisition to achieve a positive cash flow. We are about to experience the same consequences of misguided investments from a Federal Reserve-inspired bubble.

The toxic combination of lower capital expenditures and constrained output will result in another spike in prices, one that few will anticipate. The current Federal Reserve policy, which isn’t conducive to higher commodity prices, will also make the price spike more difficult to see ahead of time.However, in the interim, until policy changes at the Fed or OPEC are enacted, prices will remain below the marginal cost to maintain production.

This is especially true now that there are clear signs that the U.S. economy is weakening while the Fed chose to raise the federal interest rates in December. As we move through 2016, I expect a rash of bankruptcies tied to this transition to lower leverage, and towards the latter half of 2016 there will likely be a steep fall off of production.

Essentially most business models need to reset.

E&P companies that have a current leverage of over 4X Debt/EBITDAX and whose interest burden in some cases is over 30 percent of cash flow will eventually fail. I fully expect the new paradigm to be leverage ratios that are well under 4X Debt/EBITDAX.

Take a look at Pioneer Natural Resources (PXD) as a base case. Even with over 80 percent oil hedged through 2016, a leading cost structure and Debt/EBITDAX leverage of just over 1X, Pioneer will still not be FCF positive in 2016 and beyond according to most sell side models.

True the marginal call on cash is $500 million (25 percent of EBITDA) or more depending on the assumption of realized prices through asset sales. Furthermore it does assume double digit production growth, which will require more capital to achieve and higher cash burn but also comes with a hedge price of over $60 per barrel.

Looking at a smaller producer WPX Energy (WPX) on a flat production outlook and minimal hedges in 2016-17 with assumed WTI prices remaining under $50, they too will be free cash flow negative as leverage will remain over 3X Debt/EBITDAX approaching 4X by 2016 end. Their cash call will range from 15 percent of EBITDA to 35 percent in 2016 and 2017, according to JPM.

The point of this is that the current strip – even with hedges – doesn’t support free cash flow. That indicates that if the industry moves to free cash flow generation as a requirement and lower leverage, something has to give.

Business models are still adapting to the new paradigm. And many producers will go insolvent as debt markets close for them. Production will rationalize as depletion hits output and capital expenditures are cut further. Looking at PXD and WPX, it does not appear that this process of rationalization is over, which is especially true if prices remain under $50 per barrel. Nor has the negative feedback loop on lower capex, which spells trouble for new production to replace declining output later this year and next.

The de-leveraging that is occurring in E&P is a broader theme playing out in the global economy. Take China, for example, where growth was built on plentiful credit. But growth has slowed and credit is no longer as generous, both of which are leading to the need to correct debt levels – further fueling slower growth. I believe the Fed has realized that QE was increasingly having weaker positive outcomes. As a result it alternatively turned to a policy of a strong dollar knowing the impact on commodities. The EU QE only supports that dollar policy further in my view.

Eventually – maybe as soon as 2016 – the world will realize how wrong loose monetary policy has been and will turn back to more traditional means of growth through lower taxation and regulation. When that occurs it will come with altered Fed policy and corrections in equity and the dollar at a time when the commodity sector will not have the means to fuel supply growth.

Thus while the current downturn is not only unsustainable but is sowing the seeds for another commodity boom in prices, it will support supply growth through lower leverage and capital expenditures being primarily paid for by EBITDA or cash flow. This will require much higher commodity prices at some point.

Until then the unsustainable inverse relationship between NASDAQ and commodities will continue. The Fed’s policy has inflated assets while crushing commodities. That cannot continue indefinitely.

Tuesday, January 5, 2016

The Best And Worst Performing Assets Of 2015

Late in 2015, Germany's Handelsblatt reported, erroneously, that Venezuela was the best performing asset class of 2015.

It wasn't. The reason this was in error is because if one adjusts the returns into the real currency exchange rate, one which reflects the true implosion of the economy, instead of the government "mandated" one, the result is very different, one which shows that contrary to popular wisdom, during hyperinflation stocks are not a good store of value.

So what were the real best and worst performing assets of 2015? Here, with the full breakdown in both local currency and USD-redenominated terms, is DB's Jim Reid.

* * *

With markets wrapped up for 2015 now, reviewing the performance of asset classes last year shows that it was one where negative asset class returns were aplenty, while those finishing in positive territory were few and far between.

Indeed, of the 42 assets we monitor in Figure 5, just 9 finished with a positive return in Dollar-adjusted terms over the full year. Of these, the big winner was the Nikkei (+10.4%) - boosted by the accommodative BoJ and relatively stable Yen. In the periphery we saw both Portuguese (+6.5%) and Italian (+3.9%) equity markets also close higher, while in China the Shanghai Comp (+6.2%) finished up for the year but not without some huge volatility over the 12-months and of course ending well off the highs it posted back in June.

The S&P 500 (+1.4%) also closed just about in positive territory for the year on a total return basis although that performance was the worst for the index since 2008 as energy stocks clearly weighed for much of the year, while there was a similar return for US Treasuries (+0.8%).

At the other end of the scale there were some notable losers for us to pick out. In particular it was Oil which stole the limelight with huge falls for both Brent (-44.1%) and WTI (-30.5%) while Copper (-24.4%), Wheat (-20.3%), Silver (-11.7%) and Gold (-10.4%) were also hard hit. Both political and economic fragility saw Brazil (-42.0%) and Greece (-30.3%) fall the most in the equity space while EM equity markets finished with a broad -14.8% decline.

US Dollar strength was a big theme for 2015 as evidenced by the lack of winners above with the Dollar index returning a hefty +9.3% for the full year. This meant there were decent falls for the Euro (-10.3%), Aussie Dollar (-10.7%) and Canadian Dollar (-16.1%).

In local currency terms Russian equities (+32.3%) came out on top along with some of the peripheral markets. In the credit space it was the divergence between European and US credit which was most notable. Reflecting the higher exposure to energy credits, US HY closed with a -5.0% loss for the full year, while US IG was down a more modest -0.4%. In Europe we saw EUR HY finish +0.5% and EUR Sub Fins +1.4%, although EUR IG Corp was down -0.7%. Again converting this into US Dollar terms results in any gains for European credit being wiped out and in turn underperforming US credit for the full year.

Sunday, December 27, 2015

Mining in 2016: Six reasons to be cheerful

In our look back at 2015 we called it mining's annus horribilis.

In stead of the hoped for rebound in metals and minerals prices, just about everything from copper to crude and coal to diamonds lost more ground. Those that were calling a bottom on the commodities market in 2015 where sorely disappointed and anyone making a bullish casewere shouted down.

Capital Economics, a research firm frequently quoted in these pages, in a new note outlines its outlook for commodities in 2016.

Some metals prices already appear to have found a floor following the announcement of large cutbacks in production and new investment

Julian Jessop, Head of Commodities Research at the London-based firm, with admirable understatement says it has been "a difficult year for those, ourselves included, who have had anything positive to say about commodities."

Nevertheless, Jessop found six key drivers and themes that should help prices to recover over the course of the next year:

Nevertheless, Jessop found six key drivers and themes that should help prices to recover over the course of the next year:

- China gears up: "The bulk of the slowdown that many still fear lies ahead has, in fact, already happened; we estimate that actual growth was only 4.5% or so this year, and expect economic activity to pick up pace again during 2016."

- Dollar damage done: The strengthening greenback "has both lowered the dollar price that (non-US) consumers are able to pay and allowed commodity producers with revenues in dollars and costs in local currencies to maintain supply at a high level," but the "bulk of this move should now be over too".

- Inflation returns: "Underlying price pressures are finally starting to pick up – notably in the US – and headline inflation rates should rebound in the coming months as the biggest declines in the cost of oil drop out of the annual comparisons. This, in turn, could revive demand for inflation hedges including commodities, with gold in particular likely to benefit."

- More easy money: While the Fed will continue to raise rates in 2016, it would be because of a stronger economy and higher inflation, keeping real interest rates low. Europe and Japan will continue or accelerate its quantitative easing programs while the People's Bank of China also "has plenty of room to ease further, via cuts in interest rates and reserve requirements, without the need to resort to a big fall in the renminbi."

- Supply cuts: On top of better news on the demand side, "a recovery in the prices of many industrial commodities will probably require further evidence that supply is being tamed by the previous sharp falls. Some metals prices already appear to have found a floor following the announcement of large cutbacks in production and new investment."

- Investor interest: While investor sentiment towards commodities are still at record lows "the flipside is that there is plenty of room for money to return to the sector. Indeed, commodity prices may look increasingly attractive relative to the high valuations of equities and (especially) bonds. We would not expect investor demand to trigger a rebound in prices on its own. But speculative flows could support any recovery driven by the underlying fundamentals of supply and demand, just as highly negative sentiment has compounded the recent weakness."

The flipside is that there is plenty of room for money to return to the sector

Click here for more analysis from Capital Economics on the commodity sector.

These Are The Top 20 Companies By Market Cap Over The Past Decade

There are many observations to be made about the dramatic shifts shown in the chart below which demonstrates the top 20 companies by market cap over the past decade, but what, to us, stands out the most are two things:

- after a decade of being either the world's biggest or second largest market capitalized company, Exxon has tumbled to 5th spot, something it did not do even during the peak of the financial crisis; and

- after five years of being in the top spot, it is time for someone to finally dethrone the world's most popular smartphone maker.

Tuesday, December 15, 2015

Subscribe to:

Posts (Atom)