Premiums paid to secure aluminum are poised to exceed $500 a metric ton as soon as the coming quarter on stronger demand and limited supplies, according to United Co. Rusal (486), implying a jump of at least 20 percent.

Premiums paid to secure aluminum are poised to exceed $500 a metric ton as soon as the coming quarter on stronger demand and limited supplies, according to United Co. Rusal (486), implying a jump of at least 20 percent.

At least 75 percent of stockpiles in London Metal Exchange warehouses are tied into financing transactions and unavailable for immediate withdrawal, Deputy Chief Executive Officer Oleg Mukhamedshin said today in a telephone interview from Moscow, where the company is based. The “overall” global surcharge, added to the price on the LME, will be “well above” $500 a ton in the third quarter, he said.

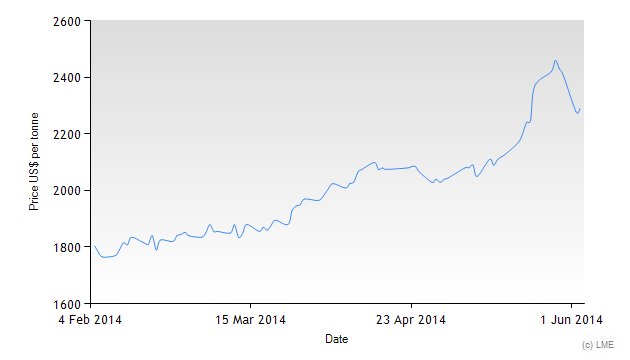

Buyers in Japan, Europe and the U.S. are paying record premiums for supplies of the lightweight metal. Stockpiles tracked by the LME fell in 19 of 20 sessions as of today to the lowest since May 2013. Aluminum for delivery in three months rose 2.5 percent this year to $1,846 a ton on the LME. A $500 premium would make up about 21 percent of total buying costs.

“There is quite a deficit in the spot market,” Mukhamedshin said. Surging premiums “should be a concern for the consumers who need to hedge.”

Buyers in Japan, Asia’s largest importer, agreed to pay a record premium for this quarter at $400 a ton. Spot premiums in Europe gained 47 percent this year to $412.50 a ton, including the European Union import duty, while the U.S. surcharge jumped 61 percent to 18.9 cents a pound ($417 a ton), according to Metal Bulletin data.

‘Strong Demand’

Aluminum usage outside China will exceed production by 1.3 million to 1.4 million tons this year on “quite strong demand,” Mukhamedshin said. Producers outside the Asian nation reduced output by about 3 million tons since 2012 and should cut a further 1.6 million tons this year, he said.

The market in China, the biggest producer and consumer of the metal, should be balanced as local output falls further, according to Rusal. The nation’s producers are losing money at current prices and output is set to slow as banks cut credit to loss-making companies, Mukhamedshin said.

Financing transactions, involving a simultaneous purchase of nearby metal and forward sale, are intended to capitalize on a market in contango, when prices rise for later deliveries. Changes in borrowing costs and storage fees affect the accords’ profitability. Aluminum for immediate delivery on the LME settled today at a $22-a-ton discount to the three-month contract, the narrowest gap since December 2012, according to data compiled by Bloomberg. That compares with $45 on Jan. 2.

Off-Warrant

“The contango is OK and interest rates are still low, so financial transactions are still profitable and the stock which goes off-warrant is still not available,” Mukhamedshin said, referring to supplies held outside the LME’s network. “This is exactly why the premiums are going up, and we expect more record-high premiums in the third quarter, well above $500 per ton.”