Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Thursday, January 15, 2015

Wednesday, January 14, 2015

Copper & Crude Convolutions: "The More This Goes On The More It Looks Like 1937"

The primacy of the monetary pyramid in 2015 is not really about money as it is all ideology. If you believe that monetary policy provides “stimulus” then you immediately remove all thoughts of any economic decline during times when monetarism is most active. Since “it works” then all else must fall into place. Contrary indications are thus given extraordinary lengths to maintain logical consistency.

Economic commentary as it exists is incredibly short-sighted, though there is no reason to believe that is anything other than exactly what I stated above. The state of economics even as a discipline has internalized Keynes so deeply that all that matters is what happens month-to-month. That makes it easier to maintain the status quo of opinion about “stimulus” – in the short run it is very easy to find a suggestion for something behaving “unexpectedly.”

That was certainly the case with crude oil prices these past few months, as the initial impulse was uniformly and incessantly prodded to over-supply. Again, the reasoning behind that was simply since “stimulus” works and it was being practiced and replicated all over the world there was no possible means by which “demand” might drop, and so precipitously. After a few weeks of oil “unexpectedly” falling further, re-assurances were more difficult and increasingly derivative by nature.

The parallel excuse was that oil prices were oil prices and that very little else “important” was behaving as was crude. And whatever commodity prices were falling in parallel fashion, that was distilled as being nothing more than either an oil “echo” or supply everywhere. This was written in November 2014:

The simple reason for the dip in commodities prices, these experts say, is that we have too much of a good thing: too much gold; a bumper crop of corn; a glut of iron ore because the big three producers, Rio Tinto, Vale and BHP Billiton have all increased output. In crude oil, members of the Organization of Petroleum Exporting Countries keep pumping out oil, while US production is at its highest level since 1986…That lack of demand is why the commodity markets aren’t forecasting bad times in the future; they’re mirroring the current dark “mood” of the commodity investor, said analysts at Citi Research in a research note from 16 November.

The article should have just come right out and stated the central theme: commodity “investors” are in a “dark mood” because the world is so good right now. And while that may hold some minor plausibility on the surface, it is, again, far too narrow and focused solely on this moment. Even if commodity prices were, in fact, trading only on over-supply, therein lies the seeds of the next economic problem anyway. What factor in this economic world would lead to such an imbalance in the first place?

After all, businesses are supposed to be set on expectations for future conditions, and this narrative more than suggests that they were decidedly bad at doing so. Producers that so over-produce themselves into big trouble are either really stupid, or led astray by prices that, at their core, don’t make fundamental sense.

In other words, even if you follow this tendency to excuse “unexpected” weakness, it still amounts to largely the same problem – an artificial “boom” predicated on artificial prices rather than something more fundamentally sound and thus sustainable. It all ends up in the same place as an imbalance that will have to be cleared via retrenchment; a fact that is missed in the euphoria of “this month is compared only to last month.”

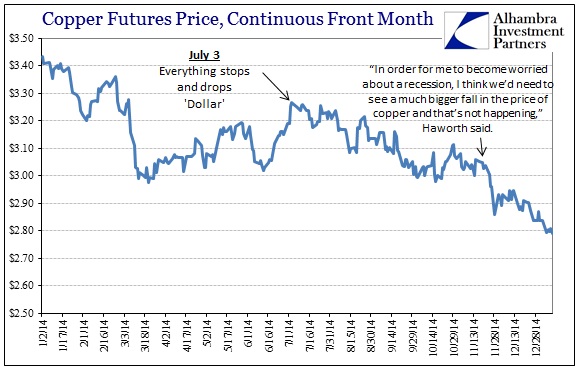

One reason Haworth said he’s not worried about a bigger global recession is the behavior of copper prices. Because the red metal has many industrial uses, commodity watchers will sometimes say copper has “a PhD in economics”, and it can be a gauge of future industrial demand. US copper futures prices have dipped below $3 a pound on rare occasions in 2014, but it’s always bounced back up. Prices currently are around $3.04.Haworth called that “heartening” and posits copper prices are suggesting that while global growth is not strong, it’s not falling apart.“In order for me to become worried about a recession, I think we’d need to see a much bigger fall in the price of copper and that’s not happening,” Haworth said. [emphasis added]

Almost immediately upon having those words printed, the price of copper declined below $3 and has remained lower ever since; in fact still falling further even now. I don’t profess to know at what price Mr. Haworth would consider low enough to change his global recession stand, but in wider context it is clear that the possibility has already been more than suggested.

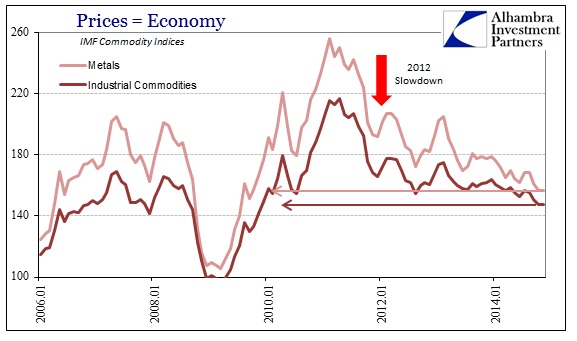

As of this morning, the front month futures price of copper delivery is almost exactly the same price as it was in June 2010 at the lows when recovery after the Great Recession was very much in doubt – leading to QE2 and the last great “rip” in commodity prices (as if that were a good thing). It only matters that copper prices are not wholly collapsing right now, in scale closer to what happened starting July 2008, if your view of the world is temporally tapered. Taking a longer view, copper prices have been falling since the 2011 apex of the $/€ crisis, with the longer-term trend established in early 2012 as global growth (demand) has done nothing but wane.

In a physical world where supply and demand have to clear at some price, it is not really surprising that a slow attrition in economic activity would show up as a much more durable and extended slide in not just copper, but almost every economically-sensitive commodity. Since that trend includes the beginning and end of QE 3 & 4, as well as innumerable “stimulus” programs in Japan, Europe, China and elsewhere, with nary a durable upward impression, it speaks very ill of the impact of monetarism on actual “demand”, even if it were “over-supply.”

The mainstream impression of all of this is one of independent and discrete trends with no unifying nature. That fits the idea that “market” prices can be as they are without disrupting the narrative of an economy on the upswing. But the financial system, especially globally, does not behave as a segregated and compartmentalized price engine – and certainly not for extended periods. The fusion of all these pieces, and why crude collapse is really indicative of the underlying trend, is, of course, the “dollar.”

In a globalized and financialized world, financial disruption, which is what a “rising” dollar signifies, is not an independent paradigm. The more prices trend exactly opposite of how “stimulus” is supposed to work, the less these convolutions will hold up whereby, eventually, reality sets in. The significance of the action in December is that there are no more lines in the sand left to defend the “honor” of monetarism; copper isn’t anywhere near $3 anymore and the long-predicted crude oil bounce to $70 is instead $45 and falling. Only equities remain, and at these valuations they signify nothing but the folly of the artificial economy. The more this goes on, the more it looks like 1937 lives again.

Sourced From Jeffrey Snider via Alhambra Investment Partners,

Copper Carnage Continues - Bloodbath At China Open

Update: COMEX Copper trades $243.40

Heavy volumes in the futures markets have smashed COMEX Copper prices to as low as $251.90 as China opens. This is the lowest level for copper since July 2009... LME prices are as low as $5,500/mt... Blame OPEC! In fact - we suspect - blame massive rehypothecation hedge unwinds...

- *COPPER DROPS BELOW $5,500/MT ON LME

- *COPPER DROPS AS MUCH AS 5.7% ON THE LME

Total Carnage

This is not a normal China open...

As Bloomberg reports, the catalyst for this latest leg down appears to be World Bank global growth forecast cuts...

Copper tumbled below $5,500 a metric ton for the first in five years as a cut in the World Bank’s global growth forecast fueled speculation demand for raw materials won’t be enough to eliminate a supply glut.Copper dropped as much as 6.6 percent and nickel slid 2.2 percent. The world economy will expand 3 percent in 2015, according to a World Bank report released today, down from a projection of 3.4 percent in June. The Bloomberg Commodity Index of 22 energy, agriculture and metal products slid to the lowest level since November 2002 yesterday after dropping 17 percent last year.“The news everywhere is doom and gloom,” said David Lennox, a resource analyst at Fat Prophets in Sydney. “Prices are going to keep sinking.”Copper for delivery in three months on the London Metal Exchange dropped as much as $388 to $5,472 a ton, the lowest intraday price since July 2009. The metal was trading 6.1 percent lower at $5,501.25 ton at 9:54 a.m. in Hong Kong.All other metals on the LME declined, with nickel dropping to the lowest since February 2014.

* * *

Maybe commodities are on to something...

Naah - stocks are all-knowing...

* * *

Copper's cost curve is coming under pressure...

* * *

Crude is also under pressure...

Marc Faber: Gold will rally 30% in 2015

Gold on Tuesday took a breather after a strong start to the year with futures contracts in New York Mercantile retreating slightly to change hands for $1,232 an ounce, down just over $2 from Tuesday's close.

Gold is still trading at its highest since October 22 after jumping more than 4% so far this year. Gold hit a near four-year low of $1,143 early November.

Marc Faber, economist, investment guru and Wall Street stalwart, came out on Tuesday as the year's biggest gold bull, saying all asset classes except precious metals are overpriced and predicting a sharp move higher for the metal:

“I’m positive [that] gold will go up substantially [in 2015] — say 30%,” Faber, whose investment letter is called the Gloom Boom Doom Report, said at Société Générale’s global strategy presentation in London on Tuesday.

“My belief is that the big surprise this year is that investor confidence in central banks collapses. And when that happens — I can’t short central banks, although I’d really like to, and the only way to short them is to go long gold, silver and platinum,” he said. “That’s the only way. That’s something I will do.”

Gold has tanked 35% since reaching an all-time high just above $1,900 an ounce in September 2011, making it one of the worst performing assets in recent years. In 2014, it lost 1.5%, following a 28% slide in 2013. So far in 2015, however, investors have taken a liking of the metal, with the front-month contract up 4.1%, outpacing gains for even a solidly performing dollar. (U.S. equities have been testing the waters on both sides of the break-even mark.)

“We simply have highly inflated asset markets. Real estate is high, stocks are high, bonds are high, art prices are high, and interest rates and short-term deposits are basically zero,” Faber said. “The only sector that I think is very inexpensive is precious metals, and in particularly precious-metals stocks.”

Faber, at times identified as “Dr. Doom,” singled out U.S. stocks as especially overvalued. Emerging markets, in contrast, could be on the cusp of another bull run, although investing in them in the early part of 2015 may be premature, he said.

“I don’t think they are that cheap. Valuations are not expensive, but they are not the bargain of the century. But I believe some time in the next six to nine months emerging economies will become relatively attractive.”

Tuesday, January 13, 2015

Gold, silver price rally: No convincing ETF investors

Gold on Monday continued to build on recent gains as sagging equity markets, a fresh slide in the price of oil and doubts about the strength of the US economy saw investors piling into safe haven assets.

In afternoon trade on the Comex division of the New York Mercantile Exchange gold for February delivery was changing hands for $1,235.60 an ounce, up $19.50 or 1.6% from Friday's close.

Gold is now trading at its highest since October 22 and has jumped more than 4% jump so far this year. Gold hit a near four-year low of $1,143 early November.

Uncharacteristically silver trade was more subdued. March contracts rose 1.1% or $0.18 to $16.60 compared to Friday's close and near the day's highs. Silver is up 6.5% in 2015 after losing some 20% of its value last year.

Last week's meagre 1.7 additional tonnes of silver can hardly be considered a trend-reversal

Roughly 60% of silver demand is from industry, with investment and jewellery demand making up the remainder, and the silver price has been dragged down by weakness in other industrial metals like copper which is trading near five-year lows.

Despite a rally in precious metals this year, investors in exchange traded funds backed by physical gold continued to lighten their exposure and silver buyers have not returned to the market in big numbers.

Despite a rally in precious metals this year, investors in exchange traded funds backed by physical gold continued to lighten their exposure and silver buyers have not returned to the market in big numbers.

Last week saw a small reduction in holdings and at 1,599.9 tonnes as at January 9, holdings in the dozens of gold-backed ETFs listed around the globe, are now down to levels last seen April 2009.

SPDR Gold Shares (NYSEARCA: GLD) – the world’s largest gold ETF holding more than 40% of the total – has been even harder hit with holdings falling to levels last seen September 2008.

Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012, but the outflows have been relentless since then.

Retail investors in silver took a different tack to gold investors last year, stocking vaults at physical silver-backed ETFs to record levels in October of 20,182 tonnes.

But the liquidation since then has been rapid (288 tonnes during the last week of 2014) and last week's meagre 1.7 tonnes addition for total holdings of 19,380 tonnes can hardly be considered a trend-reversal.

Sunday, January 11, 2015

McHugh's Fearless Forecast for 2015: The Stock Market

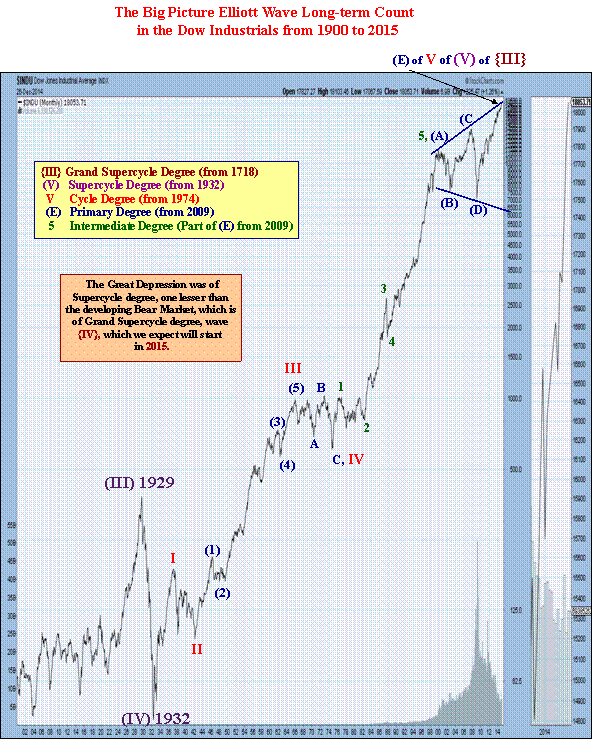

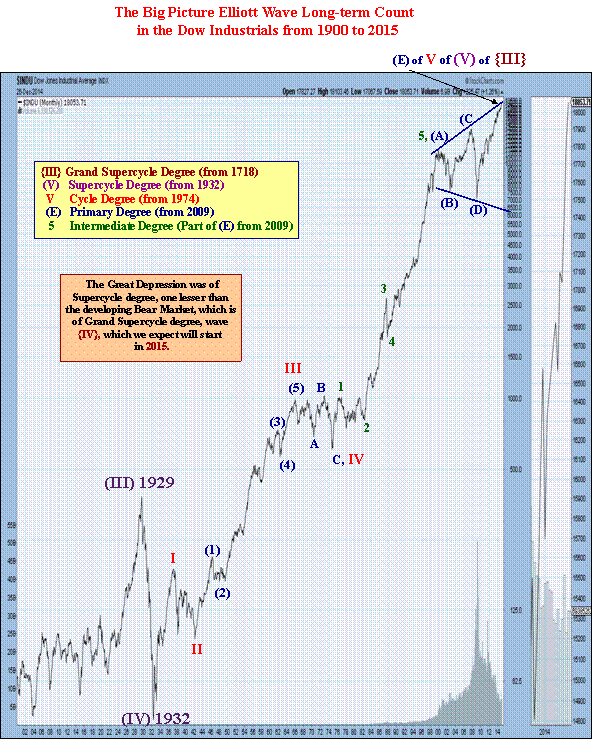

As 2014 has closed, we want to present our view of where markets are headed in 2015 in a series of coming articles. Toward the end of this series, we will cover real estate and the economy, something slightly different than what we normally cover in our market reports, but something you may find quite interesting. Let's start by saying this: The year 2015 will be historic, with unusual events and high market volatility.

The Stock Market

We believe there will be at least one stock market crash in 2015 (a decline of 15 percent or greater, probably much greater than a 15 percent decline), with perhaps one or more mini-crashes (10 percent or more). We believe that the largest stock market decline in 2015 will be a crash, and that this crash will be underway (could last several weeks or months) within two weeks before or after September 14th, 2015. In other words, we see a stock market crash in the latter third of 2015. It could be huge, and could change the financial, political and regulatory landscape for years to come.

There is a convincing amount of evidence for this in this author's opinion. First is the multi-decade Jaws of Death pattern. It is finished or will be by the latter part of 2015, and warns of a mega-decline in the stock market, and an economic depression. I wrote a book about this (available at amazon.com) that many of you have read. The time will be at hand for the fulfillment of this stock market pattern in 2015.

The second convincing piece of evidence is a cycle pattern we follow that is rare and extremely correlative to stock market declines and economic downturns, pointing to a powerful economic and market collapse around September 14th, 2015. This cycle pattern was present for the 2008 and 2001 market plunges. It will be present again in 2015, the first time it has been evident since 2008. Then there is the Bradley model which is an astro cycle turn indicator which points toward a turn on September 23rd, 2015. We also have a Phi Mate Turn date scheduled for September 15th, 2015.

The multi-decade Jaws of Death stock market pattern is calling for an economic collapse and a market collapse. This is a Bear market for the ages coming, which we believe is already starting in stealth, masked by the artificial stock market rally whose main purpose has been to hide the truth about the underlying economy's collapse, including the unannounced disintegration of the middle class in America. Part and parcel with Bear markets are social strife issues. A negative psychological state of mankind.

One developing social strife that will have an enormous negative effect upon the stock market and the economy is the civil war that is breaking out in the United States between liberals and conservatives. It is time to call it what it is, a civil war. We see this in Washington's inability to govern and negotiate. We see this with our judicial systems' decision-making being driven ideologically, interpreting laws according to the justices' in power political views and personal values, with relativism and the ends justifies the means enforcement of American jurisprudence evident in many cases. The divide is wide and passions are at the brink of violence. Truth is being redefined as a point of view. The U.S. Constitution is being rewritten by court decisions and precedent cases that could be completely distant from what is written on that sacred piece of paper. The plain language of the U.S. Constitution is being ignored and replaced by pseudo intellectual hyperbole. This brewing civil war will be a contributing factor in the destruction of the economy and the stock market in 2015 and beyond, not to mention America's traditional values and way of life.

Do Stocks Always Fall After Crude Crashes?

Not always, but you will have to consider modern finance this time?

Modern finance

- Hedging protection

- Debt and derivatives blow ups associated with Oil companies.

- Percentage of economic growth lost verses benefit of cheaper oil.

- Debt and derivatives blow ups associated with Oil companies.

- Percentage of economic growth lost verses benefit of cheaper oil.

As always timing is the factor, how much pain will be felt before we get the gain? The next 12 months will be rocky as the bad oil news flows through the market.

Chart: Crude oil on top, Dow Jones on the bottom.

Source readtheticker.com

Subscribe to:

Posts (Atom)