Base Metals Aluminium, Copper, Lead, Nickel, Zinc. Bullion Gold, Silver. Energy Crude Oil, NG. Forex USD, INR, Euro, Yuan. Economic Data Reports. LME, COMEX, NYMEX, MCX, Shanghai Markets.

Monday, June 8, 2015

World’s 2nd Biggest Stock Breaks 28-Year Trendline

On March 24, we posted a rare piece on an individual stock. As we do not invest in individual stocks, they are typically not our focus. Therefore, it takes extraordinary circumstances to inspire a post on a single stock. That was the case with the March 24 post which noted the fact that Exxon Mobil (XOM), the world’s 2nd biggest stock, was testing a trendline that began back in 1987.

The origin of the trendline, based on a logarithmic scale of XOM, is the low point of the October 1987 crash. It then precisely connects the 1994 and 2010 lows. Interestingly, the stock stopped on a dime in March once it hit the vicinity of the post-1987 trendline. I say interestingly because, at the time, the stock appeared to be in no-man’s land. There were no obvious support or resistance levels in the vicinity. And yet, the stock stopped right on the trendline. It then proceeded to “walk up” the trendline for the next 18 days.

To those who dismiss the influence of technical analysis and charting techniques on the behavior of stocks as completely random, I can hardly think of a better example of counter-evidence than this. What are the odds that a stock “respecting”, or adhering to, a nearly 3 decade-old trendline is completely random – for 18 days? Furthermore, after bouncing off this trendline into May, XOM returned to it over the past few weeks. It spent 6 straight days sitting squarely (again) on the trendline…before breaking below it yesterday.

This breakdown marks the first day that Exxon Mobil has ever closed below this trendline. Now, assuming the stock’s behavior around the trendline is not completely random, and considering its capacity as the 2nd biggest stock in the equity market, the effect of this breakdown may be profound. Absent an immediate reversal back above the trendline, this loss of 28-year support would appear to open the door to more downside in the stock.

Sourced : By Dana Lyons, partner at Lyons Fund Management and founder of 401kPro.com

Fear of Fall in China Zinc Oxide Consumption Overdone, SMM Sees

The possible delay of new standards for compound rubber will have positive impact on zinc oxide consumption, Shanghai Metals Market foresees.

China is due to implement new standards for compound rubber on July 1, 2015, but market players speculate that the standards might be carried out later than scheduled.

Tuesday, June 2, 2015

Dollar knocks gold price back below $1,200

Large scale speculators in gold futures sharply reduced bets on a rising price as the metal is once again rebuffed at the $1,200 an ounce level.

On Monday gold for delivery in August – the most active futures contract – raced out of the gate to reach a day high of $1,205 only to fall back just below Friday's closing price at $1,189.20

Gold has been hovering either side of $1,200 for the best part of three months, but has not been able to break higher, stymied by a strong dollar.

The greenback was trending higher on Monday with the US dollar index reaching a month high against major world currencies.

The dollar is up 21% in value over the past year and is trading near 12-year highs against the yen and multi-year highs against the euro. The euro and the dollar usually move in opposite directions.

As gold retreated further from 3-month highs hit mid-May large investors on the gold futures like hedge funds or so-called "managed money" last week slashed their bullish positions.

In the week to May 26 according to the Commodity Futures Trading Commission's weekly Commitment of Traders data, hedge funds added to short positions – bets that prices are declining – and at the same time slashed their long positions.

On a net basis hedge funds are now long 7.3 million ounces down 16% from last week, nearly 10 million ounces below levels hit in January this year, but still well off the 3.1 million ounces position held mid-March.

Copper submerges below $6000 as global factories sputter

(Reuters) -Copper prices slid back below the $6,000 a tonne mark on Tuesday, after a string of global manufacturing reports revealed only modest demand growth for metals with just one month left of the normally strongest quarter for seasonal demand.

FUNDAMENTALS

* Three-month copper on the London Metal Exchange slipped by 0.4 percent to $5,999 a tonne by 1241 GMT, after closing little changed in the previous session when it plumbed its lowest since April 24 at $5,985 a tonne.

* The most-traded August copper contract on the Shanghai Futures Exchange slipped 0.6 percent to 43570 yuan ($7,029) a tonne.

* Manufacturing activity showed few signs of picking up across Europe, Asia or the Americas in May as demand stayed stubbornly weak, highlighting the need for central banks to continue supporting economic growth.

* The leaders of Germany, France and Greece's international creditor institutions agreed late on Monday to work with "real intensity" in the coming days as they try to clinch a deal in debt negotiations with Athens.

* U.S. consumer spending growth unexpectedly stalled in April as households cut back on purchases of automobiles and continued to boost savings, suggesting the economy was struggling to gain momentum early in the second quarter.

* Mining conflicts in Peru, a top global minerals exporter, will likely heat up ahead of presidential and congressional elections next year as political outsiders whip up anti-mining sentiment, government officials and business leaders said.

($1 = 6.1985 Chinese yuan renminbi)

Friday, May 29, 2015

Oil Prices Drop To 7-Week Lows - Here's Why

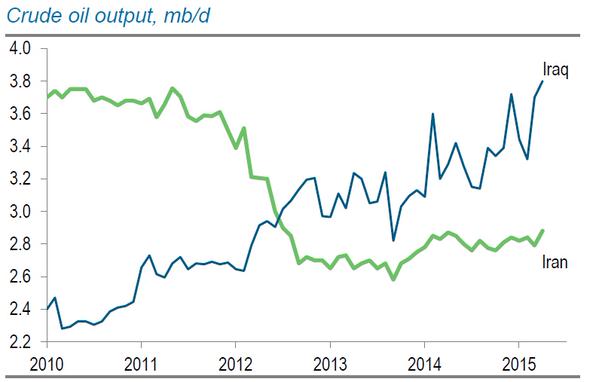

WTI Crude hit new 7-week lows, dropping below $57 (front-month) for the first time since April 15th's 'inventory draw' rip. In addition to reports from Reuters of leaked details about OPEC not expectated to cut production (did anyone really expect that), a combination of renewed inventory builds (as reported by API last night) and reports that Iraq is increasing its supply to new record highs is forcing futures prices to catch down to physical markets.

Weakness driven by...Iraq supply concerns...(as RT reports)

Iraq is ready to increase its crude exports to a record 3.75 million barrels per day in June, continuing OPEC’s strategy of ousting US shale producers from the market.The extra oil from Iraq comes to about 800,000 barrels per day, more than from another OPEC member, Qatar, said Bloomberg, referring to Iraq's oil shipments schedule.Iraq is increasing oil exports in two directions. The first is in the Shiite south, where companies such as BP and Royal Dutch Shell work. The second is Nothern Iraqi Kurdistan, whose government last year received Baghdad's consent to independent oil deliveries.In April, Iraq exported almost 3.1 million barrels of oil per day, which is a record.

And inventory builds reappear...

And leaked details of OPEC's report suggests no cut in production... (via Reuters)

OPEC is not expected to cut oil production at its meeting in June, and the meeting is expected to be a short one, Saudi Arabia's Al Hayat newspaper quoted an unnamed OPEC source as saying on Thursday.Saudi Arabia will continue producing oil to meet customer demand, and its output is now at about 10.3 million barrels per day in light of growth in demand from China and India, the source added.

* * *

Source : www.zerohedge.com

Tuesday, May 26, 2015

World Biggest Mining Companies Betting on Copper

There’s still some uncertainty regarding how soon copper will shift into deficit. However, positive arguments for the copper price got some support on Friday when a report from Bloomberg stated that five of the world’s largest mining companies have all said good things about the red metal over the last month.

BHP Billiton (NYSE:BHP,ASX:BHP,LSE:BLT) CEO Andrew Mackenzie sees copper as the exception in an otherwise uninspiring market space, while Jean-Sebastien Jacques of Rio Tinto’s (NYSE:RIO,ASX:RIO,LSE:RIO) copper division simply said in an interview, “we love copper.”

Meanwhile, Antofagasta’s (LSE:ANTO) Diego Hernandez continues to be skeptical of a copper surplus, with Glencore (LSE:GLEN) CEO Ivan Glasenberg echoing that sentiment, telling shareholders on May 7 that his company believes copper is moving into deficit. For his part, Freeport-McMoRan (NYSE:FCX) Chief Executive Richard Adkerson has reaffirmed his belief in copper’s strong mid- to long-term fundamentals.

Overall, it looks like there’s a fairly similar message coming from all five miners. That’s worth some attention from investors given that the companies certainly haven’t seen eye to eye on a number of other issues as of late. For example, Rio Tinto CEO Sam Walsh has held strong to plans to continue growing the company’s iron ore exports, while BHP has indicated that it will slow its iron ore expansion program.

Deficit timeline uncertain

Recently, Rio changed its prediction regarding a copper surplus, saying that a deficit will come sooner than expected. “If you had asked me the question in December last year I would have said the inflection point would be three or four years down the road and today it is likely to be 18-24 months down the road,” Jacques told the Financial Times in an interview earlier this month. This week, the company reached an agreement with the government of Mongolia for a $5-billion expansion at its Oyu Tolgoi mine.

On top of that, a growing number of analysts are predicting that a deficit will come sooner rather than later. Mineweb’s Kip Keen has pointed out that a growing number of companies and analysts are turning more positive on copper, and while firms like Thomson Reuters GFMS and the International Copper Study Group are still calling for a surplus this year, most see a growing deficit coming within the next 10 years due to a lack of new mines set to come online in the medium term.

Cast in point: Thomson Reuters is forecasting that this year the copper price will average 12 percent lower than in 2014, but sees the incentive price for new mine development as being $7,073 per tonne; it believes the metal could rise that high within two to three years. Further, Cormark Securities said in March that it’s staying bullish on copper in the medium term, while Macquarie Research and Dundee Securities also see copper prices rising.

The upshot

The spot copper price was down last week, having lost nearly 4 percent to close at $2.79 per pound. Still, the red metal has risen about 8 percent in the last three months, taking back a respectable portion of its losses from the beginning of the year.

In any case, at least some market watchers are responding well to the world’s biggest mining companies and their attraction to copper. Forbes contributor Trefis has upped its price estimate for Freeport-McMoRan from $17.41 to $21.62, largely on what it sees as improved pricing environments for copper and oil, and the company’s share price has managed to gain about $0.42 over the past month.

Subscribe to:

Posts (Atom)